Traci Cook and Denise Garrett of Yeo & Yeo Medical Billing & Consulting Receive Credentials

Two associates within Yeo & Yeo Medical Billing & Consulting have received professional credentials.

Traci Cook completed the required training to become a Certified Professional Medical Auditor (CPMA®) through the American Academy of Professional Coders. The knowledge required for this certification includes medical documentation, fraud, abuse, and penalties for documentation and coding violations based on governmental guidelines. Traci’s expertise will benefit the company’s healthcare clients as she performs medical record audits to decrease risk and improve compliance.

Traci is a billing and coding consultant and an account manager and has been with Yeo & Yeo Medical Billing & Consulting since 1999. She is a Certified Professional Coder with expertise in the coding of diagnoses, services, and procedures for physician practices, clinics and third-party payors. She is a member of the American Academy of Professional Coders and the Michigan Medical Billers Association.

Denise Garrett completed the required training to become a Certified Physician Practice Manager (CPPM®), through the American Academy of Professional Coders. The knowledge required for this certification includes revenue cycle management, human resources, health information and general business processes. Denise’s expertise will benefit the company’s medical practice clients as she focuses on their business needs including operational efficiencies, staff training, and technology.

Denise is an account manager and has been with Yeo & Yeo Medical Billing & Consulting since 1998. She is a Certified Professional Coder and a Certified Foot & Ankle Surgical Coder, with expertise in the coding of diagnoses, services, and procedures for physician practices.

Learn more about medical billing and practice management consulting services offered by Yeo & Yeo Medical Billing & Consulting.

A renaissance is occurring in the brewing industry — consumers’ tastes are shifting away from the products of the leading beer manufacturers and toward small craft brewers. The craft beers have distinct tastes and are quickly gaining a larger piece of the overall beer market. The industry is growing at such a rapid rate that many are considering jumping in on the action. The question is, then, what should someone looking to start a new operation consider before finishing their pint and making the next one themselves?

The four main ingredients in beer are grain, hops, yeast and water. Each of these is relatable to a functional part of accounting that is important if you ever decide to scale up and brew for the world or even your local watering hole.

Grain – Grain is combined with hot water and is transformed into a brew-ready malt. This combination causes the grain to create enzymes that transform proteins and starches into fermentable sugars for the yeast to feed on and create alcohol. Much like the transformation of the grain, your accounting transformation begins with numbers in your head, then eventually materializing in an advanced accounting software.

An accounting software will help you track your receivables, sales, expenses and whatever else you need to create your next batch. As the business grows, you can add on third party apps that help with the brewing process. These apps are synced with your accounting software to take your efficiency to the next level. This hands-off accounting process will leave you more time for quality control!

The options available for accounting software are endless, but the key is having one. Yeo & Yeo’s Computer Accounting Solutions Group regularly evaluates accounting software and third party apps to align the correct option to the needs of our clients and create custom reports. The process of selection and implementation is simple when you are working with a professional who understands your unique needs.

Hops – Hops are used primarily as a flavoring and stability agent in beer which can create bitter, zesty, or citric flavors. In addition, hops are a preservative and extend the life of beer. When it comes to accounting, an immediate need that affects your stability is knowing when to file the proper paperwork.

Tax planning today can impact the success of tomorrow. Part of tax planning is having a professional who knows which forms need to be filed and when. The professionals will also open your eyes to available tax credits and help minimize tax burdens over the life of the business.

Now when it comes to stability and filing paperwork on time, your tax returns for local, state, and federal governments are just the beginning for a brewery. You will encounter requested forms from banks and the liquor control commission. Working with an accountant who understands your needs and maintains a close working relationship with your attorneys and bankers will be key in keeping your business running smoothly.

Yeast – This feeds on the fermentable sugars mentioned above which creates alcohol and carbon dioxide. It creates the finishing touch and many brewers consider this their secret ingredient. Yeast has cell-splitting capabilities, but the $5 bill in my hand does not unless it is used to create $10 worth of beer. Make your investment multiply just like the yeast by creating a profitable operation and understanding items such as break-evens and cash flows.

Water – This component can account for up to 95% of beer’s content and affects the pH, seasoning from the sulfate to chloride ratio, and can cause off flavors from chlorine to contaminants. So what is the most important part of accounting for a new brewery? Actually doing all three of the previously mentioned items, of course. If you complete only one or some of these foundations for beer, your next batch probably won’t be a big hit since it will not be beer. The same goes for the accounting since without doing the items above, your business will not be a desired brew and likely be dumped down the drain.

You may be able to get by for a short period of time without doing these items, but sooner or later your hops will run out. So as you craft your next recipe that includes the four main ingredients of beer, make sure your plans for your new brewery include the four main ingredients of accounting so we can all enjoy your creations for years to come. And for the love of beer if you have accounting questions, or need help, call me so the rest of us are able to enjoy your next concoction!

It has come to our attention through state monitoring reviews, and from questions throughout the school nutrition industry, that school districts need to be aware of new standards when hiring nutrition program employees.

The Healthy, Hunger-Free Kids Act of 2010 established professional standards for state and local school nutrition programs personnel. The U.S. Department of Agriculture’s Final Rule, published on March 2, 2015, clarified the Act with an effective date of July 1, 2015.

The Final Rule includes hiring standards, training standards, and training requirements. The goal is to improve the quality of student meals, reduce waste and improve the overall integrity of child nutrition programs.

The Final Rule provides comprehensive guidance:

- Annual continuing education/training standards for all school nutrition program employees, based on position

- Training requirements for all state agency directors

- Hiring standards for new school nutrition program directors, including minimum education standards broken down by school student enrollment and minimum prior training standards.

- Hiring standards for new state directors, including education, knowledge and experience, and skills and abilities minimum criteria.

The complete details of the Final Rule are available at http://www.fns.usda.gov/school-meals/professional-standards.

Furthermore, if multiple schools are utilizing a single food service director, the Michigan Department of Education (MDE) released additional clarification guidance on how to calculate student enrollment size. See the MDE Food Service Administrative Policy No. 12 School Year 2016-2017.

If you have questions, contact your Yeo & Yeo professional.

Several months ago, the Michigan Department of Education (MDE) issued guidance in an administrative policy that requires districts to put a written Meal Charging Policy in place. With that, a Bad Debt Policy is also required. The guidance was the topic of many discussions, and parts of the guidance did not seem practical. Although it is still a bit confusing, MDE has now clarified many of the issues and made it more feasible.

Here are the highlights that are most helpful:

- A written Meal Charging Policy is required to be in place at all districts effective 7/1/17.

- The policy should include a Bad Debt Policy (unless done separately).

- Bad Debt is an unallowable cost in the Food Service Fund (this has always been the case).

- MDE clarified what “bad debt” is — bad debt is an uncollectible balance for inactive students only. Therefore, if the student still attends the district, they are active and would not have to be written off.

- Any “bad debt” must be written off both on the Food Service Fund and the District’s POS system.

- The Food Service Fund must be made whole for any bad debt. For example, the General Fund (or possibly an activity fund) would have to make a transfer to cover the bad debt.

- Once an account has been determined to be bad debt, the district’s business office is responsible for trying to collect those balances, not the Food Service Department.

- The uncollectible balances must be tracked and collected by the business office by December 31 (not June 30).

Here is a link to several pieces of guidance on the Michigan Department of Education’s website: MDE School Nutrition Program. Also, the USDA website has some helpful guidance as well, specifically in the area of unpaid meal charges: USDA – Schools Nutrition.

If you have questions, contact your Yeo & Yeo professional.

Occupational fraud is an unfortunate reality for just about every employer, governmental entity or otherwise. But you might be able to reduce the risk of costly losses if you understand some of the common traits of fraud perpetrators. The 2016 Report to the Nations on Occupational Fraud and Abuse from the Association of Certified fraud Examiners (ACFE) provides some useful insights on these characteristics.

How old are the perpetrators?

The ACFE found that 55% of the fraudsters in its study were between the ages of 31 and 45, and the size of the losses rose with the age of the perpetrator. It identified a “line of demarcation” around the age of 40: In all age ranges at or below that age, the highest median loss was $100,000, while the median loss in the ranges above age 40 was $250,000 or higher.

fraud losses also tend to increase the longer a fraudster has worked for the victim organization. Those with six to ten years’ tenure caused a median loss of $210,000, and those with more than ten years’ tenure caused a median loss of $250,000. People who remain with an organization for a long time often move up to higher levels of authority, the ACFE notes, and that gives them the opportunity to commit larger misdeeds.

Which gender are they?

Fraud obviously isn’t limited to one gender, but 69% of perpetrators in the ACFE study were male. This is consistent with gender distributions in previous studies.

Moreover, men generally cause larger losses. The median loss caused by a male perpetrator was $187,000, while the median loss caused by a female was $100,000. This disparity also is consistent with previous studies.

What about educational level?

Perpetrators with a college degree caused a median loss of $200,000, and those with postgraduate degrees rang up a median loss of $300,000. These losses were significantly higher than the losses caused by less educated fraudsters.

The ACFE theorizes that the discrepancy may be heavily influenced by the perpetrator’s department and position of authority. The perpetrators with degrees were more likely to be managers or owner-executives. Higher-level fraudsters are better positioned to override or circumvent anti-fraud measures, so their schemes are harder to detect, run longer and generate more losses.

What should you look for?

Perpetrators tend to exhibit some red flags that may indicate fraud. In the study, of the 17 traits identified, the most common warning signs were:

- Living beyond their means,

- Financial difficulties,

- Unusually close association with a vendor or customer,

- Excessive control issues,

- A general “wheeler-dealer” attitude involving unscrupulous behavior, and

- Recent divorce or family problems.

At least one of the six indicators listed above was displayed in 79% of the cases.

It’s important to remember that the behaviors described above are merely signs of fraud — they aren’t conclusive. Further investigation is required before you take any action, particularly with suspension or termination.

Stay alert

The ACFE estimates that organizations lose 5% of their annual revenues to occupational fraud. That’s a significant chunk of change for any organization, especially a budget-conscious governmental unit. If you suspect your governmental unit might have fallen prey to a fraud perpetrator, or just want to do everything you can to help combat it, your CPA can help.

Regardless of the size of your nonprofit organization, well-documented policies and procedures are an essential component to your continued success. Most nonprofit organizations are designed to carry on their missions beyond the tenure of their current directors, employees and trustees. With that in mind, a well-documented Policies and Procedures manual should serve as a roadmap to operating at your organization’s peak potential. Additionally, get the most mileage from your efforts by using the policies and procedures as a tool to:

- Train new employees, and fill in the gaps after an employee’s unexpected departure

- Define roles and responsibilities regarding your organization’s internal controls

- Hold employees accountable to roles and responsibilities, including frequency of performing certain duties

- Reduce the risk of fraud by ensuring adequate segregation of duties and oversight

- Comply with documentation requirements set by government grantors, in particular, awards subject to the Uniform Grant Guidance

- Improve efficiency in the organization and streamline processes

- Document cost allocation methodologies

With so many possible uses, it is imperative not only to establish a Policies and Procedures manual, but also keep it up to date. A good rule of thumb to ensure it is up-to-date is to review existing policies and procedures at least annually, or more frequently during periods of operational change or employee turnover. Using calendar reminders or recurring board agenda items are a great way to integrate this into the organization’s routine. During these reviews, pay particular attention to the following:

- Unnecessary redundancies in controls

- Controls that have been replaced by automated processes

- Adequate documentation regarding intended flow of information and responsibilities for documenting approval and oversight

- Appropriate dollar thresholds (including those used for capitalizing fixed assets, use of dual check signers, level of authorization needed for purchases, approval of journal entries, setting employee credit card or P-card limits, board approval of grant contracts, and determining de-minimus gift acceptance thresholds, among others)

The effectiveness of a Policies and Procedures manual requires not only diligence in keeping it up-to-date, but acceptance by those responsible for ensuring its success, including both management and boards. Therefore, management should play a key role in developing, operating and monitoring the established manual, while the board or its designee should review the effectiveness of the policies, procedures and related internal controls. While a template Policies and Procedures manual will rarely capture all the policies and procedures applicable and necessary for each organization, this Policies and Procedures to Document table can serve as a great starting point for developing or evaluating the current processes.

For more information and guidance, contact your Yeo & Yeo advisor.

What’s the value of a financial advisor?

Two studies found that working with a financial professional can result in higher returns and potentially lower personal stress.

Lower Stress

Seventy-seven percent of people within 11-15 years of retirement are stressed when thinking about retirement savings and investments.¹

Working with a financial advisor to develop a written retirement income strategy, however, can increase your financial confidence leading up to retirement, according to Franklin Templeton’s annual Retirement Income Strategies and Expectations Survey.

With and Without²

| Investors… | Worry about running out of money | Worry about being a burden on family |

| With an advisor | 23% | 5% |

| Without an advisor | 30% | 6% |

Higher Returns In addition to providing financial guidance, financial advisors may also add about three percentage points in net portfolio returns over time, according to a study by Vanguard.³

Financial Advisor Advice Components⁴

| Advice | Advice Elements | Potential Added Return to Investor Portfolio |

| Portfolio Construction | Asset allocation Asset location |

Up to 1.2% |

| Wealth Management | Rebalancing Drawdown strategies |

Up to over 1% |

| Behavioral Coaching | Managing investor emotions Aiding decision-making |

Up to 1.5% |

It’s important to remember that financial advisors also may offer guidance that wasn’t measured in the two studies. Advisors can help develop strategies that protect against the financial consequences of loss of income, and coordinate with other financial professionals on tax and estate management.

1. Franklin Templeton, 2016

2. Franklin Templeton, 2016

3. Vanguard.com, 2015

4. Vanguard.com, 2015

Now that Affordable Care Act (ACA) repeal and replacement efforts appear to have collapsed, at least for the time being, it’s a good time for a refresher on the tax penalty the ACA imposes on individuals who fail to have “minimum essential” health insurance coverage for any month of the year. This requirement is commonly called the “individual mandate.”

Penalty exemptions

Before we review how the penalty is calculated, let’s take a quick look at exceptions to the penalty. Taxpayers may be exempt if they fit into one of these categories for 2017:

- Their household income is below the federal income tax return filing threshold.

- They lack access to affordable minimum essential coverage.

- They suffered a hardship in obtaining coverage.

- They have only a short-term coverage gap.

- They qualify for an exception on religious grounds or have coverage through a healthcare sharing ministry.

- They’re not a U.S. citizen or national.

- They’re incarcerated.

- They’re a member of a Native American tribe.

Calculating the tax

So how much can the penalty cost? That’s a tricky question. If you owe the penalty, the tentative amount equals the greater of the following two prongs:

- The applicable percentage of your household income above the applicable federal income tax return filing threshold, or

- The applicable dollar amount times the number of uninsured individuals in your household, limited to 300% of the applicable dollar amount.

In terms of the percentage-of-income prong of the penalty, the applicable percentage of income is 2.5% for 2017.

In terms of the dollar-amount prong of the penalty, the applicable dollar amount for each uninsured household member is $695 for 2017. For a household member who’s under age 18, the applicable dollar amounts are cut by 50%, to $347.50. The maximum penalty under this prong for 2017 is $2,085 (300% of $695).

The final penalty amount per person can’t exceed the national average cost of “bronze coverage” (the cheapest category of ACA-compliant coverage) for your household. The important thing to know is that a high-income person or household could owe more than 300% of the applicable dollar amount but not more than the cost of bronze coverage.

If you have minimum essential coverage for only part of the year, the final penalty is calculated on a monthly basis using prorated annual figures.

Also be aware that the extent to which the penalty will continue to be enforced isn’t certain. The IRS has been accepting 2016 tax returns even if a taxpayer hasn’t completed the line indicating health coverage status. That said, the ACA is still the law, so compliance is highly recommended. For more information about this and other ACA-imposed taxes, contact us.

© 2017

Tax reform has been a major topic of discussion in Washington, but it’s still unclear exactly what such legislation will include and whether it will be signed into law this year. However, the last major tax legislation that was signed into law — back in December of 2015 — still has a significant impact on tax planning for businesses. Let’s look at three midyear tax strategies inspired by the Protecting Americans from Tax Hikes (PATH) Act:

1. Buy equipment. The PATH Act preserved both the generous limits for the Section 179 expensing election and the availability of bonus depreciation. These breaks generally apply to qualified fixed assets, including equipment or machinery, placed in service during the year. For 2017, the maximum Sec. 179 deduction is $510,000, subject to a $2,030,000 phaseout threshold. Without the PATH Act, the 2017 limits would have been $25,000 and $200,000, respectively. Higher limits are now permanent and subject to inflation indexing.

Additionally, for 2017, your business may be able to claim 50% bonus depreciation for qualified costs in excess of what you expense under Sec. 179. Bonus depreciation is scheduled to be reduced to 40% in 2018 and 30% in 2019 before it’s set to expire on December 31, 2019.

2. Ramp up research. After years of uncertainty, the PATH Act made the research credit permanent. For qualified research expenses, the credit is generally equal to 20% of expenses over a base amount that’s essentially determined using a historical average of research expenses as a percentage of revenues. There’s also an alternative computation for companies that haven’t increased their research expenses substantially over their historical base amounts.

In addition, a small business with $50 million or less in gross receipts may claim the credit against its alternative minimum tax (AMT) liability. And, a start-up company with less than $5 million in gross receipts may claim the credit against up to $250,000 in employer Federal Insurance Contributions Act (FICA) taxes.

3. Hire workers from “target groups.” Your business may claim the Work Opportunity credit for hiring a worker from one of several “target groups,” such as food stamp recipients and certain veterans. The PATH Act extended the credit through 2019. It also added a new target group: long-term unemployment recipients.

Generally, the maximum Work Opportunity credit is $2,400 per worker. But it’s higher for workers from certain target groups, such as disabled veterans.

One last thing to keep in mind is that, in terms of tax breaks, “permanent” only means that there’s no scheduled expiration date. Congress could still pass legislation that changes or eliminates “permanent” breaks. But it’s unlikely any of the breaks discussed here would be eliminated or reduced for 2017. To keep up to date on tax law changes and get a jump start on your 2017 tax planning, contact us.

© 2017

Unemployment tax rates for employers vary from state to state. Your unemployment tax bill may be influenced by the number of former employees who’ve filed unemployment claims with the state, your current number of employees and your business’s age. Typically, the more claims made against a business, the higher the unemployment tax bill.

Here are six ways to control your unemployment tax costs:

1. Buy down your unemployment tax rate if your state permits it. Some states allow employers to annually buy down their rate. If you’re eligible, this could save you substantial dollars in unemployment taxes.

2. Hire new staff conservatively. Remember, your unemployment payments are based partly on the number of employees who file unemployment claims. You don’t want to hire employees to fill a need now, only to have to lay them off if business slows. A temporary staffing agency can help you meet short-term needs without permanently adding staff, so you can avoid layoffs. This is also a good way to try out a candidate.

3. Assess candidates before hiring them. Often it’s worth a small financial investment to have job candidates undergo prehiring assessments to see if they’re the right match for your business and the position available. Hiring carefully will increase the likelihood that new employees will work out.

4. Train for success. Many unemployment insurance claimants are awarded benefits despite employer assertions that the employee failed to perform adequately. Often this is because the hearing officer concluded the employer hadn’t provided the employee with enough training to succeed in the position.

5. Handle terminations thoughtfully. If you must terminate an employee, consider giving him or her severance as well as offering outplacement benefits. Severance pay may reduce or delay the start of unemployment insurance benefits. Effective outplacement services may hasten the end of unemployment insurance benefits, because the claimant has found a new job.

6. Leverage an acquisition. If you’ve recently acquired another company, it may have a lower established tax rate that you can use instead of the tax rate that’s been set for your existing business. You also may be able to request the transfer of the previous company’s unemployment reserve fund balance.

If you have questions about unemployment taxes and how you can reduce them, contact our firm. We’d be pleased to help.

© 2017

Yeo & Yeo, a leading Michigan accounting firm, has completed the move of its Saginaw office (headquarters) to 5300 Bay Road in Saginaw. The move includes relocation of Yeo & Yeo CPAs & Business Consultants Saginaw office and affiliates Yeo & Yeo Technology, Yeo & Yeo Medical Billing & Consulting, and Yeo & Yeo Financial Services.

“Yeo & Yeo’s new headquarters reflects our desire to bring our affiliates together under one roof in a modern environment that fosters greater cross-discipline collaboration and innovation, while further strengthening our ability to attract the best and brightest professionals. The result will be a stronger, more responsive, more efficient and forward-thinking firm,” said Thomas Hollerback, president & chief executive officer of Yeo & Yeo.

Yeo & Yeo purchased the former Davenport University building in April 2016, having reached capacity at its Saginaw location on Davenport Avenue. The Bay Road building offered 30,000 square feet of space; another 14,000 square feet was added to accommodate all affiliates and allow for future growth of up to 160 professionals.

Jeff McCulloch, president of Yeo & Yeo Technology, said, “We were simply out of space, so this move will allow us to keep pace with our clients’ growing needs. The technology advances and open-concept office spaces in the new building create greater efficiency to be recognized by our employees and clients.”

The newly renovated, energy-efficient and technology-driven space, currently housing more than 120 Saginaw office employees, reinforces the firm’s mission of delivering outstanding business solutions:

- State-of-the-art conferencing capabilities allow effective communication with their clients and colleagues, who span locations throughout Michigan and beyond

- Flexible collaborative spaces foster a team-driven atmosphere and promote interaction

- Large, open spaces with ample natural light provide a bright, energizing environment

- Ergonomic and efficient work spaces create better workflow and support well-being

“A commitment to the communities we live and work in has been a long-standing part of Yeo & Yeo’s culture – we are committed to keeping our headquarters rooted in the Saginaw community,” said David W. Schaeffer, managing principal of Yeo & Yeo’s Saginaw office. “We have served our clients from the Davenport location for more than 40 years. Moving to the new location is a milestone for the firm, and demonstrates our commitment to serving our community, maintaining a motivating environment for staff and providing top-notch support for our clients – both locally and globally.”

Yeo & Yeo’s new Saginaw office (headquarters) is located at the corner of Bay Road and Trautner Drive, next to Garber Bay Road, and offers convenient access for our clients and professionals in and around the Great Lakes Bay Region.

Yeo & Yeo employs nearly 220 professionals and has nine offices throughout Michigan. During the last three years, Yeo & Yeo’s Ann Arbor and Lansing offices also relocated within their communities to accommodate growth and offer a contemporary work environment for employees.

Read more about Yeo & Yeo’s relocation.

In the quest to reduce your tax bill, year end planning can only go so far. Tax-saving strategies take time to implement, so review your options now. Here are three strategies that can be more effective if you begin executing them midyear:

1. Consider your bracket

The top income tax rate is 39.6% for taxpayers with taxable income over $418,400 (singles), $444,550 (heads of households) and $470,700 (married filing jointly; half that amount for married filing separately). If you expect this year’s income to be near the threshold, consider strategies for reducing your taxable income and staying out of the top bracket. For example, you could take steps to defer income and accelerate deductible expenses. (This strategy can save tax even if you’re not at risk for the 39.6% bracket or you can’t avoid the bracket.)

You could also shift income to family members in lower tax brackets by giving them income-producing assets. This strategy won’t work, however, if the recipient is subject to the “kiddie tax.” Generally, this tax applies the parents’ marginal rate to unearned income (including investment income) received by a dependent child under the age of 19 (24 for full-time students) in excess of a specified threshold ($2,100 for 2017).

2. Look at investment income

This year, the capital gains rate for taxpayers in the top bracket is 20%. If you’ve realized, or expect to realize, significant capital gains, consider selling some depreciated investments to generate losses you can use to offset those gains. It may be possible to repurchase those investments, so long as you wait at least 31 days to avoid the “wash sale” rule.

Depending on what happens with healthcare and tax reform legislation, you also may need to plan for the 3.8% net investment income tax (NIIT). Under the Affordable Care Act, this tax can affect taxpayers with modified adjusted gross income (MAGI) over $200,000 ($250,000 for joint filers). The NIIT applies to net investment income for the year or the excess of MAGI over the threshold, whichever is less. So, if the NIIT remains in effect (check back with us for the latest information), you may be able to lower your tax liability by reducing your MAGI, reducing net investment income or both.

3. Plan for medical expenses

The threshold for deducting medical expenses is 10% of AGI. You can deduct only expenses that exceed that floor. (The threshold could be affected by healthcare legislation. Again, check back with us for the latest information.)

Deductible expenses may include health insurance premiums (if not deducted from your wages pretax); long-term care insurance premiums (age-based limits apply); medical and dental services and prescription drugs (if not reimbursable by insurance or paid through a tax-advantaged account); and mileage driven for healthcare purposes (17 cents per mile driven in 2017). You may be able to control the timing of some of these expenses so you can bunch them into every other year and exceed the applicable floor.

These are just a few ideas for slashing your 2017 tax bill. To benefit from midyear tax planning, consult us now. If you wait until the end of the year, it may be too late to execute the strategies that would save you the most tax.

© 2017

Since 1955, the State of Michigan has exempted various prosthetic devices from sales and use tax. In 1985, the Treasury issued Letter Ruling 1985-20 addressing sales of a specific type of dental prosthetic (dental ceramics), essentially including these dental prosthetics with other exempt devices. When Letter Ruling 1985-20 was issued, the sales and use tax acts exempted “any … apparatus, device, or equipment used to replace or substitute for a part of the human body …”

With the passage 100c of 2004 Michigan Public Acts 172 and 173, the sales and use tax acts directed that dental prosthetics were excluded from the statutory exemption under the definition of “prosthetic device.” These acts defined a “prosthetic device” as “a replacement, corrective, or supportive device, other than contact lenses and dental prosthesis, dispensed under a prescription, including repair or replacement parts for that device, worn on or in the body …” Since Letter Ruling 1985-20 was still in effect, the 2004 Michigan Public Acts did not change how prosthetic devices were taxed.

In June 2017, the Michigan Department of Treasury announced that it had revoked Letter Ruling 1985-20 effective July 1, 2017. For transactions before this date, dental labs do not need to collect sales tax on custom dental products.However, the Treasury now considers the dentist the end user, as they use the material in the services they provide to their patients.After July 1, dental lab sales of dental prostheses to dentists are subject to sales tax based on the sales price of the prosthetic.

Because these transactions will now be treated as a sale at retail, dental labs may claim the industrial processing exemption for property used in manufacturing its products, if the property used to make such dental products qualifies for the industrial processing exemption.

Please contact your Yeo & Yeo professional if you have questions.

For 18 years, you have carefully saved for your child’s education using a 529 plan, accumulating a sizable sum, but your child has earned a scholarship or two—so now what? First of all, congratulations, both you and your child have much to celebrate! But now what should you do with the extra 529 funds to minimize penalties and tax?

First, note that section 529 funds can be used for more than just tuition and fees—other expenditures qualify too. This includes textbooks, internet expense, a computer and any software used primarily for education. And then there is the big one, room and board for your student if attending at least half time.

Not living on campus? No problem! Colleges and universities annually publish a “cost of attendance” calculation for each school year, which details the approximate amount of room and board. You may make tax-free distributions from a 529 plan up to this amount for a student not living on campus. For students actually living on campus, if this price exceeds the quote in the cost of attendance, the actual amount spent may be distributed.

Still going to have funds left? There are a few other options. First, if there is another child you would like to name as the beneficiary, the accounts may be transferred between siblings, or even to a spouse or first cousin, but make sure that the beneficiary has changed before making distributions for the newly appointed student, or this can cause you tax headaches down the road.

If there is no other potential beneficiary, any excess amounts up to the amount of scholarships earned may be withdrawn without penalty; however, any earnings on the withdrawal would be subject to tax. See the following example:

Sam has a scholarship that pays for all tuition annually, which is expected to be $10,000. Sam’s parents have saved diligently and, even after making withdrawals for room and board, they are expecting to have $40,000 left over in the account, as it was the amount anticipated for tuition ($10,000 x 4 Years = $40,000).

In year one, $10,000 above the amount for room board and other expenses is withdrawn. The 10% penalty does not apply, as Sam has scholarships of $10,000, which is what caused the overfunding in the 529 plan. At the time of withdrawal, 60% of the account is contributions, 40% is earnings. As the beneficiary of the account, Sam will pay income tax on the $4,000 in earnings that are withdrawn.

In year two, $11,000 (55% contributions, 45% earnings) above the amount for room and board and other expenses is withdrawn. Sam incurs $10,000 in tuition and fees, all of which is covered by a scholarship. In this case, the earnings portion of $1,000 ($1,000 x 45%=$450) of the $11,000 is subject to a 10% penalty for being a distribution in excess of the amount of scholarship covered expenses, which in this case would be $45 ($450 x 10%). $4,950 ($11,000 x 45%), the amount of earnings from the distribution, is also subject to income tax.

Fortunately, students are often in a lower tax bracket, which lessens the tax sting somewhat. If you will make 529 plan distributions, check with your tax professional to set the best course to minimize the tax implications of distributions, along with maximizing any educational credits for which you may qualify.

The recent announcement that procurement requirements related to Uniform Guidance have once again been delayed is not cause to return the issue to the back burner. The implementation date is scheduled for July 1, 2018. This extension should be utilized as a trial period to work out the problems instead of a procrastination period to create more. This article provides a summary of the procurement section of the 2 CFR 200 to make the changes seem a little easier to tackle.

As a refresher, the principles related to Uniform Guidance were developed to help unify, clarify, simplify, and standardize the numerous federal grant requirements previously in play. The new guidance provided 80 fewer pages than the combined circulars it replaced in the hopes of eliminating duplicative or conflicting guidance. The document focuses on leveraging technology, minimizing waste, fraud and abuse, and shifting the focus from compliance to performance. The document still boasts a whopping 140+ pages of information related to federal grant compliance; however, the general tone is one of outcomes.

In addition to focusing on outcomes, the 2 CFR 200 moved internal control guidance into administrative requirements with the purpose of enforcing stronger underlying systems before federal expenditures are incurred. In the past, this section was only included in the audit requirements, which resulted in noncompliance only after the funds were spent. This focus is one of the underlying reasons for the procurement changes that organizations should implement to satisfy the new requirements by the July 1st deadline.

Although 140+ pages may seem like an overwhelming place to start, the 2 CFR 200 is a relatively simple read. The following summary is intended to help lay the groundwork for procurement changes, but a knowledge of the actual requirements will greater ensure your organization’s compliance.

General procurement requirements start at §200.318 of the Uniform Guidance. One of the first items to note is that every entity must have its own documented procurement procedures. In the past, various organizations provided example documents that could be leveraged, but ultimately the procurement procedures must be specific to your organization. It cannot be a generic document.

General procurement also states that procedures should identify if insubstantial financial interests or nominal value gifts are acceptable. If this is not explicitly written into a procurement procedure manual, the default is that none are allowed. Also, general procurement states that procedures must avoid acquisition of duplicative or unnecessary items. This section further encourages inter-entity agreements when appropriate to extend the reach of resources, and also encourages that lease versus purchase analysis are performed as necessary. Also, the new guidance requires written conflict of interest policies that address the selection, award, and administration of procured vendors. It also requires that violations are met with disciplinary action.

It is important that your procurement procedures address the oversight of contractors to ensure they are performing in accordance with their contract, which should be written to include necessary federal grant requirements. If there is any knowledge that a contractor is not considered responsible and unable to perform successfully, the organization should not award them any federal contracts. Contractor oversight leads into the next section of the procurement requirements that addresses full and open competition.

This section of the 2 CFR 200 (§200.319) specifically states that when contractors are involved in the developing and/or drafting of specifications, requirements, statements of work, and invitations to bid or RFPs, they cannot compete for that procurement. In addition, the procurement procedures should encourage competition by requiring that a clear and accurate description of technical requirements, minimum essential characteristics of the product (detailed product specifications should be avoided, if at all possible), all requirements offerors must fulfill, and the factors to be used in evaluating bids/proposals, be included in every RFP.

To further ensure competition, prequalification lists must be current and include enough qualified sources to ensure open and free competition. Situations considered to be restrictive of open competition include the following:

- Placing unreasonable requirements on firms in order for them to qualify to do business.

- Requiring unnecessary experience and excessive bonding.

- Noncompetitive pricing practices between firms or between affiliated companies.

- Noncompetitive contracts to consultants that are on retainer contracts.

- Organizational conflicts of interest.

- Specifying only a “brand name” product instead of allowing an “equal” product to be offered.

- Any arbitrary action in the procurement process.

- Geographical preferences unless a federal statute is mandated or encouraged

Directly following General Procurement and Competition is the area of the upcoming procurement changes that most organizations will need to address now. This section (§200.320) contains the five allowable procurement methods that must be written into every organization’s procurement policies and utilized as needed. The five procurement methods are:

1)Micro-purchases (new for government): aggregate does not exceed $3,500 ($10,000 for some organizations)

An organization should distribute equitably among qualified suppliers and only need consider the price reasonable.

2)Small purchases: cost less than Simplified Acquisition Threshold ($150,000)

Price or rate quotations from an adequate number of qualified sources (no definition of adequate, but judgment would state more than 1)

3)Sealed bids: if complete specifications, two or more responsible bidders, and procured item lends itself to firm fixed-price contract

Publicly advertise invitation for bids, all bids publicly opened at time and place prescribed in invitation, firm, fixed-price contract awarded to lowest responsive and responsible bidder, sound reasons for rejection must be documented, consideration given to discounts, transportation costs, and life cycle costs.

4)Competitive proposal: if conditions are not appropriate for a sealed bid, there is more than one source, and the procured item lends itself to a fixed-price or cost-reimbursement contract

Requests for proposals must be publicized and identify all evaluation factors and relative importance, solicited from an adequate number of qualified sources, a written method for conducting technical evaluations of proposals and selecting recipients, award to “most advantageous” proposal including price and other factors. Only architectural/engineering can use selection without consideration of cost

5)Noncompetitive proposals (restrictions on usage 100c new for nonprofits): if only available from one source, or if public exigency or emergency that will not permit delay, or if federal awarding agency or pass-through entity expressly authorizes, or after soliciting a number of sources competition is determined inadequate

Solicitation from only one source

It is likely that your organization is already utilizing some or all of the methods above, so the change is not expected to be drastic. The most drastic change is thoroughly documenting the method selected and ensuring procurement procedures are properly updated to include all five of these methods. The form of documenting the method selected can vary as 2 CFR 200 is focused on the ‘what’ not the ‘how.’ Utilizing current software is one recommendation as every vendor disbursement should be run through your accounting system. Making note of a micro or small purchase item in the description or another field of the software may be an efficient way to document the method. Even writing the method on each invoice will do the trick as long as you remember to do so. However you choose to implement, start now. Practice for the upcoming fiscal year, so that when it comes time for your audit after July 1, 2018, you are fully in compliance.

Other items to mention in the 2 CFR 200 procurement section include contract cost and price analysis guidelines at §200.323, as well as suspended and debarred parties. An organization must perform cost or price analysis in connection with every procurement over the Simplified Acquisition Threshold. Cost plus percentage of cost, and percentage of construction cost methods are never allowed in federal procurement. Also, a contract award must not be made to parties listed on the government-wide exclusions in the System for Award Management (SAM). Ensure that there is a system in place to regularly monitor federal vendors with this website at https://www.sam.gov/.

As a reminder, the complete 2 CFR 200 can be found at: https://www.federalregister.gov/articles/2013/12/26/2013-30465/uniform-administrative-requirements-cost-principles-and-audit-requirements-for-federal-awards. Learn more about the implementation of Uniform Guidance.

July 1, 2018 will be here in no time and another extension should not be relied upon. We encourage you to use the additional time and the contents of this article to help you implement procurement changes now, so you will not have to say UGH! to UG procurement later!

Under new accounting rules effective for fiscal years beginning after December 15, 2017, all nonprofits will now be required to show an analysis of expenses by both function and nature. Functional expense allocation can be challenging for nonprofits. Expenses must be divided among various functions, according to the purpose for which the costs are incurred.

- What nuances have changed in the new standard, even for those who have prepared a statement of functional expenses for years?

- What are the differences between the types of functional expense classifications — program services, supporting services, management and general expenses, and expenses incurred for fundraising?

- Which expense allocation method should be used — direct or indirect?

- Does expense allocation change for a federal grant?

Yeo & Yeo is pleased to offer an updated whitepaper, Functional Expense Allocation for Nonprofits after FASB ASU 2016-14, that explains functional classifications and other issues to consider in allocating expenses for your organization under the new accounting rules.

Beyond meeting compliance requirements, there are very good reasons to care about the functional classification of expenses, as they help tell the story of a nonprofit. If you have a question, reach out to Yeo & Yeo’s Nonprofit experienced professionals.

During the past few years, the construction industry has seen a shortfall in the number of skilled tradesmen available for employment. The shortage has caused business owners grief in trying to maintain proper staffing for the jobs that they bid on and perform. There are many reasons for the decline in the availability of qualified workers: the older generation retiring from the workforce, immigration laws that the Trump administration has proposed, and added pressure on millennials to go to a traditional, post-secondary school for education instead of seeking opportunities in the skilled trades.

I recently spoke with a construction client I work closely with, and when I asked how busy he was during this time, he said that he had to turn down some work; much of this was the result of the inability to retain good help. He has tried to incentivize working at his company by offering better wages and more relaxed hours but, in the end, a lot of the workers he has are simply not qualified to perform the work the way he demands. Most applicants he sees do not have proper training in the trade, and therefore would be behind from the start.

Fortunately, construction organizations within Michigan have realized this is a very real problem and have set initiatives to counteract this dilemma. By partnering with and providing funding for local trade schools and construction academies, the number of qualified, skilled tradesmen is on the rise. The curriculums allow the students in the program to explore the many different sectors of the industry – everything from carpentry and electrical, to plumbing and pipefitting. This allows the students to identify which area within the skilled trades best suits their abilities.

The best way for construction business owners to get in front of this new talent is to reach out to local construction academies (for example, Mount Pleasant Vocational/Tech Center or the Greater Michigan Construction Academy in Midland). The academies can put you in contact with the talent that they have.

Donating to charity is more than good business citizenship; it can also save tax. Here are three lesser-known federal income tax breaks for charitable donations by businesses.

1. Food donations

Charitable write-offs for donated food (such as by restaurants and grocery stores) are normally limited to the lower of the taxpayer’s basis in the food (generally cost) or fair market value (FMV), but an enhanced deduction equals the lesser of:

- The food’s basis plus one-half the FMV in excess of basis, or

- Two times the basis.

To qualify, the food must be apparently wholesome at the time it’s donated. Your total charitable write-off for food donations under the enhanced deduction provision can’t exceed:

- 15% of your net income for the year (before considering the enhanced deduction) from all sole proprietorships, S corporations and partnership businesses (including limited liability companies treated as partnerships for tax purposes) from which food donations were made, or

- For a C corporation taxpayer, 15% of taxable income for the year (before considering the enhanced deduction).

2. Qualified conservation contributions

Qualified conservation contributions are charitable donations of real property interests, including remainder interests and easements that restrict the use of real property. For qualified C corporation farming and ranching operations, the maximum write-off for qualified conservation contributions is increased from the normal 10% of adjusted taxable income to 100% of adjusted taxable income.

Qualified conservation contributions in excess of what can be written off in the year of the donation can be carried forward for 15 years.

3. S corporation appreciated property donations

A favorable tax basis rule is available to shareholders of S corporations that make charitable donations of appreciated property. For such donations, each shareholder’s basis in the S corporation stock is reduced by only the shareholder’s pro-rata percentage of the company’s tax basis in the donated asset.

Without this provision, a shareholder’s basis reduction would equal the passed-through write-off for the donation (a larger amount than the shareholder’s pro-rata percentage of the company’s basis in the donated asset). This provision is generally beneficial to shareholders, because it leaves them with higher tax basis in their S corporation shares.

If you believe you may be eligible to claim one or more of these tax breaks, contact us. We can help you determine eligibility, prepare the required documentation and plan for charitable donations in future years.

© 2017

The tax consequences of the sale of an investment, as well as your net return, can be affected by a variety of factors. You’re probably focused on factors such as how much you paid for the investment vs. how much you’re selling it for, whether you held the investment long-term (more than one year) and the tax rate that will apply.

But there are additional details you should pay attention to. If you don’t, the tax consequences of a sale may be different from what you expect. Here are a few details to consider when selling an investment:

Which shares you’re selling. If you bought the same security at different times and prices and want to sell high-tax-basis shares to reduce gain or increase a loss to offset other gains, be sure to specifically identify which block of shares is being sold.

Trade date vs. settlement date. When it gets close to year end, keep in mind that the trade date, not the settlement date, of publicly traded securities determines the year in which you recognize the gain or loss.

Transaction costs. While transaction costs, such as broker fees, aren’t taxes, like taxes they can have a significant impact on your net returns, especially over time, because they also reduce the amount of money you have available to invest.

If you have questions about the potential tax impact of an investment sale you’re considering — or all of the details you should keep in mind to minimize it — please contact us.

© 2017

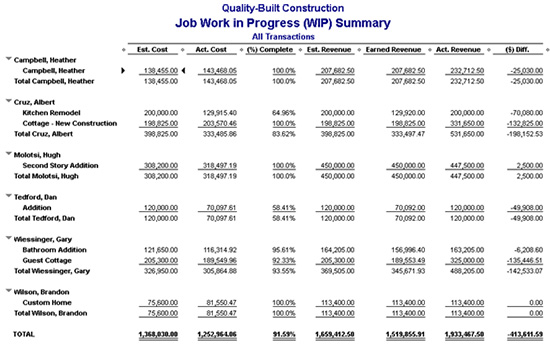

What if you need to see the profitability of a project while it’s happening? You may be struggling with matching the timing of your revenue to your costs because you invoice in advance of the work being completed. The Job Work in Progress Report (WIP) Summary can be used by contractors or other businesses that progress or advance bill their customers.

The WIP Report Summary provides a synopsis of a project’s related information such as estimated and actual cost, the percent complete and the estimated, earned and actual revenue.

Find the Job Work in Progress Summary by Choosing Reports, then Jobs, Time & Mileage. Then select Job WIP Summary.

Note: Only jobs with a related Estimate transaction in QuickBooks will appear on this report.

When viewing the report, you’ll see an Earned Revenue column. This column provides the amount you’ve earned on the job, regardless of how much you have invoiced to the customer. This is calculated by taking the Estimated Revenue column and multiplying by the (%) Complete column.

The (%) Complete column is derived by dividing The Actual Cost column by the Estimated Cost column. In other words, the report assumes that if you have incurred a certain portion of your total estimated expenses, then that same % of revenue has been earned. In many cases, the amount of earned revenue will vastly differ from the amount that has been invoiced to the customer. The ($) Diff column essentially becomes your “over/under billed” amount and can be used to make the accounting adjustment in QuickBooks.

Note: if a job’s expenses are over budget, the (%) Complete column will assume the job is 100% complete.

© 2017