Are Frequent Flyer Miles Ever Taxable?

If you recently redeemed frequent flyer miles to treat the family to a fun summer vacation or to take your spouse on a romantic getaway, you might assume that there are no tax implications involved. And you’re probably right — but there is a chance your miles could be taxable.

Usually tax free

As a general rule, miles awarded by airlines for flying with them are considered nontaxable rebates, as are miles awarded for using a credit or debit card.

The IRS partially addressed the issue in Announcement 2002-18, where it said “Consistent with prior practice, the IRS will not assert that any taxpayer has understated his federal tax liability by reason of the receipt or personal use of frequent flyer miles or other in-kind promotional benefits attributable to the taxpayer’s business or official travel.”

Exceptions

There are, however, some types of mile awards the IRS might view as taxable. Examples include miles awarded as a prize in a sweepstakes and miles awarded as a promotion.

For instance, in Shankar v. Commissioner, the U.S. Tax Court sided with the IRS, finding that airline miles awarded in conjunction with opening a bank account were indeed taxable. Part of the evidence of taxability was the fact that the bank had issued Forms 1099 MISC to customers who’d redeemed the rewards points to purchase airline tickets.

The value of the miles for tax purposes generally is their estimated retail value.

If you’re concerned you’ve received mile awards that could be taxable, please contact us and we’ll help you determine your tax liability, if any.

© 2016

Ransomware is a malicious software that blocks user access to data and demands payment to restore access. Ransomware criminal networks are continuously finding new ways to hijack your information. Now, we have discovered that cyber criminals have begun to use macro-enabled Word, Excel, Access and Powerpoint files to compromise data. Macros are a set of programming instructions that can be used to eliminate the need to repeat the steps of commonly performed tasks over and over again.

As a precaution, do not open file attachments from senders you are not familiar with. If the email is coming from a sender you know, you should verify with the sender that they intended to send the attached file. In order to keep your vital information secure, we suggest that you inform all of your employees and family members about this issue and advise them to be cautious before opening any files they have received via email. Also be wary of files provided to you on USB drives.

If you would like to learn more about Ransomware or our Security Awareness Training, please contact Yeo & Yeo Technology today.

The FASB recently released the first of two phases of its project to improve the financial reporting for Non-Profit (NFP) entities. Read the Accounting Standards Update.

Who will be affected?

The amendments in this update affect all NFPs and the users of their general purpose financial statements.

What are the main provisions?

The main provisions of this update, which amend the requirements for financial statements and notes in Topic 958, Non-Profit Entities, require an NFP to:

- Present on the face of the statement of financial position amounts for two classes of net assets at the end of the period, rather than for the currently required three classes.

- Provide enhanced disclosures, including the following about:

1. The effects, if any, of the limits on the use of resources imposed by an NFP’s governing board, donors, grantors, laws, and contracts on an NFP’s liquidity, financial flexibility, and allocation of resources

2. How an NFP manages its liquidity to meet short-term demands for cash

3. The types of resources used and how they are allocated in carrying out an NFP’s activities

4. The effects, if any, of methods used for allocating costs among an NFP’s program and supporting activities

5. The effects, if any, of underwater endowments

- Eliminate the current option to release donor imposed restrictions on long-lived assets over the useful life of the acquired asset.

When are the amendments effective?

The amendments in this update are effective for annual financial statements issued for fiscal years beginning after December 15, 2017, or in other words for December 31, 2018 year-ends. Early application of the amendments is permitted. The amendments should be applied on a retroactive basis in the year the update is first applied.

If you have questions about how the FASB update will impact your entity, reach out to your Yeo & Yeo professional.

Recently I attended the Construction Industry CPAs/Consultants (CICPAC) conference in Chicago. The conference is held annually and provides Yeo & Yeo professionals with the latest knowledge of construction industry challenges, and valuable insight that we will use to advise our clients.

I attended eight sessions, and I would like to share my notes about the following topics that I consider especially important to our clients.

1. Be aware of the most common reasons why contractors fail.

Ryan Howsam of FMI, a leading management consulting firm dedicated to serving the construction industry, says that the most common root causes for failure include the following:

- Not planning resources needed to complete jobs

- Taking on projects too far outside of capabilities

- Moving outside of the company’s core competencies

- Inadequately managing large, long-duration projects causing significant equity, cash, and working capital to be tied up in uncompleted work

The top risks today include skilled craft labor shortages, contract language/insurance terms, and subcontractor default.

2. Consider cash flows while jobs are plentiful.

Anirban Basu of the sage 100c Policy Group recapped the state of the construction industry over the past few years and shared the detailed economic outlook for construction going forward. Michigan is recovering from the recession and has seen 4.7 percent growth in construction jobs. We may be transitioning very quickly from the mid-cycle stage of the recovery to the late-stage: The 2017-2018 outlook is very murky. He stressed that it is very important to think about cash flows at this time while the jobs are plentiful on the market. The economy is starting to show signs of slowing down during the next few years, so having the necessary reserves now is crucial for all contractors.

3. Maintain a solid workforce.

Finding good help can be a difficult hurdle to overcome, but retaining those individuals is an even harder task. Spending more money on good help will make each job more efficient and, while it costs more in the short term, it bolsters the company’s reputation. The better the reputation of the company, the more likely the company can secure contracts in the future.

4. Data management and asset security are crucial to the construction industry.

Several construction CEOs shared their top concerns for the construction industry. Data management and asset security are the most crucial. Implementing a solid data network with backups is not something that can be overlooked because a disaster can happen at any time. Ask yourself, in the event of a disaster, is your data offsite and secure? If the answer is unknown, or worse, if the answer is no, then the success of your company could hang in the balance with just one mishap. Consider learning more about backup and disaster recovery by seeking technology solutions for your business.

Call on Yeo & Yeo’s Construction Services Group for assistance with business consulting, tax planning, accounting, employee benefits and IT security.

If your loved ones have invested, saved or insured themselves to any degree, you may be named as a beneficiary to one or more of their accounts, policies or assets in the event of their deaths. While we all hope “that day” never comes, we do need to know what to do financially if and when it does.

Legally, just who is a beneficiary? IRAs, annuities, life insurance policies and qualified retirement plans such as 401(k)s and 403(b)s are set up so that the accounts, policies or assets are payable or transferrable on the death of the owner to a beneficiary, usually an individual named on a contractual document that is filled out when the account or policy is first created.

In addition to the primary beneficiary, the account or policy owner is asked to name a contingent (or secondary) beneficiary. The contingent beneficiary will receive the asset if the primary beneficiary is deceased.

Some retirement accounts and policies may have multiple beneficiaries. Charities are also occasionally named as beneficiaries. If you have individually listed one (or more) of your kids or grandkids as designated beneficiaries of your 401(k) or IRA, that designation will usually override any charitable bequest you have stated in a trust or will.

A will is NOT a beneficiary form. When it comes to 401(k)s and IRAs, beneficiary designations are commonly considered first, and wills second. Be mindful of who you select. If you willed your IRA assets to your son in 2008, but named the man who is now your ex-husband as the beneficiary of your IRA back in 1996, those IRA assets are set up to transfer to your ex-husband in the event of your death.

If a retirement account owner passes away, what steps need to be taken? First, the beneficiary form must be found, either with the IRA or retirement plan custodian (the financial firm overseeing the account) or within the financial records of the person deceased. Beyond that, the financial institution holding the IRA or retirement plan assets should also ask you to supply:

- A certified copy of the account owner’s death certificate

- A notarized affidavit of domicile (a document certifying his or her place of residence at the time of death)

If the named beneficiary is a minor, a birth certificate for that person will be requested. If the beneficiary is a trust, the custodian will want to see a W-9 form and a copy of the trust agreement.

If you are named as the primary beneficiary, you usually have three options for claiming the assets, regardless of what kind of retirement savings account you have inherited:

- Open an inherited IRA and transfer or roll over the funds into it.

- Roll over or transfer the assets to your own, existing IRA.

- Withdraw the assets as a lump sum (liquidate the account, get a check).

Before you make any choice, you should welcome the input of a tax advisor, and discuss any limitations or consequences that may apply to your situation.

What if you are a spousal beneficiary? If that is the case, you may elect to:

- Roll over or transfer assets from a traditional IRA, Roth IRA, SEP-IRA or SIMPLE IRA into your own traditional or Roth IRA, or an inherited traditional or Roth IRA.

- Withdraw the assets as a lump sum.

- Roll over or transfer qualified retirement plan assets from a 401(k), 403(b), etc. into your own retirement account, or take them as a lump sum.

What if you are a non-spousal beneficiary? If this is so, you may elect to:

- Roll over or transfer assets from a traditional IRA, Roth IRA, SEP-IRA, SIMPLE IRA or qualified retirement plan into an inherited IRA.

- Withdraw the assets as a lump sum.

What if a qualified (i.e., irrevocable) trust is named as the beneficiary? If that is the circumstance, the trustee has two choices:

- Transfer assets from a traditional IRA, Roth IRA, SEP-IRA, SIMPLE IRA or qualified retirement plan into an inherited IRA.

- Withdraw the assets as a lump sum.

The next calendar year will be very important. Inheritors of retirement accounts have until September 30 of the year following the original account owner’s death to review and remove beneficiaries, and until December 31 of that year to divide the IRA assets among multiple beneficiaries. Usually, December 31 of the year after the original retirement plan owner’s passing is the deadline for the first RMD (Required Minimum Distribution) from an inherited traditional or Roth IRA.

Now, how about U.S. Savings Bonds? If you are named as the primary beneficiary of a U.S. Treasury Bond, you have three options:

- Redeem it at a financial institution (you will need your personal I.D. for this).

- Get the security reissued in your name or the names of multiple beneficiaries. You do this via Treasury Department Form 4000, which you must sign before a certifying officer at a bank (not a notary). Then send that signed form and a certified copy of the death certificate to a Savings Bond Processing Site.

- Do nothing at all, as the primary beneficiary automatically becomes the bond owner when the original bond owner passes away.

What about savings & checking accounts? Bank accounts are often payable-on-death (POD) assets or “Totten trusts.” All a beneficiary needs to claim the assets is his or her personal identification and a certified copy of the death certificate of the original account holder. There is no need for probate. (Some states limit charities and non-profits from being POD beneficiaries of bank accounts.)

How about real estate? Finally,it is worth noting that about a dozen states use transfer-on-death (TOD) deeds for real property. If you live in such a state, you have to go to the county recorder or registrar, usually with a certified copy of the death certificate and a notarized affidavit which informs the recorder or registrar that ownership of the property has changed. If the deed names multiple beneficiaries and some are dead, the surviving beneficiaries must present the recorder or registrar with certified copies of the death certificates of the deceased beneficiaries.

Provided by Michael L. Espinoza, CRPC

GuideStar is a website that provides impartial information about nonprofit organizations to the public for free. The website receives basic details about the organizations from the IRS, including contact information and a copy of Form 990. However, GuideStar encourages each nonprofit to claim its own profile in order to provide in-depth information that could interest donors, supporters and partners.

How to update your nonprofit’s profile

Claiming and updating an organization’s profile is free for all nonprofits. Simply go to the GuideStar website (www.guidestar.org) and click on “Update Nonprofit Profile.” First, request permission to manage the profile, which should be processed within two business days, and then you will have access to customize the profile as desired. At a minimum, it is recommended that you add the names and contact information for the primary contact, organization leader, and board chair, along with the organization’s mission statement, geographic areas served and program names. Financial data and a description of the organization’s impact may also be added. Any changes that are made should be reflected on the GuideStar website within 48 hours.

Benefits of updating your nonprofit’s profile

Benefits provided by GuideStar, which vary based on the amount of information that is added to the profile, can include:

- Adding a GuideStar participation logo to the organization’s website and printed materials

- Access to the GuideStar promotional toolkit

- Priority access to registration for GuideStar webinars

- Discounted resources available from GuideStar partners, including training courses, fundraising tools and volunteer recruitment

More importantly, customizing a GuideStar profile allows you to share the organization’s story from your own perspective, including adding links to your website and social media pages. Keeping the profile current can also attract potential donors since fundraising websites, such as AmazonSmile, JustGive, and Network for Good pull organizations’ information directly from GuideStar.

It is important for nonprofits to increase their visibility and transparency in order to raise funds that will allow them to continue to serve the public. Personalizing an organization’s GuideStar profile is a free tool that will help accomplish this goal, so we encourage you to go to GuideStar’s website (www.guidestar.org) for more information and to get started.

On August 2, 2016, the U.S. Treasury issued proposed regulations under Internal Revenue Code Section 2704 that place new restrictions on the common practice of realizing valuation discounts on transfers of family-controlled entities. The Treasury believes these regulations are necessary to close a tax loophole in what it perceives to be an understatement of fair market value of family controlled interests for transfer tax purposes.

If the proposed regulations are finalized in current form, they would overturn techniques that for decades have allowed valuation discounts to be applied to these interests as part of a family’s overall business succession plan. In short, valuation discounts for lack of control (minority interest discounts) would go away, with very little room to work with to achieve discounts. The result would be less ability to leverage lifetime transfer tax exemptions and a substantial increase in transfer taxes payable at the transfer of the interests, whether during life or at death.

These regulations are currently only proposed and they could change substantially, or they could be left intact. A public hearing is scheduled for December 1, 2016, and the regulations could become effective at that point.

If you have been considering transferring closely held business interests either through lifetime gifts or at death, we recommend that you consult with your estate planning attorney and other advisors quickly to determine if action before December 1 is advisable.

If you need assistance with this or other gift and estate planning issues, please contact your Yeo & Yeo professional.

Ninety-seven percent of all farms in the United States are family-owned, but the vast majority of those operations do not have a succession plan in place. In today’s agribusiness environment, it is crucial to be proactive in terms of planning, because nothing is guaranteed. Succession planning can be a very emotional process for all the parties involved, but it is crucial to secure the future of both the farm and the individuals who take part.

Family farms face unique challenges

Numerous aspects need to be addressed, and each situation is unique. The elder generation may have a difficult time letting go of the operation they have built, while the younger generation is excited to take over and attempt to further grow the business. It is important to carefully plan the entire process, and to make the succession to the next generation a gradual transition. One way to help ease this process is for a transitioning planning professional to meet with both sides to understand what plans they have in mind, and then create the best plan considering the input of both generations.

During the planning process, many questions should be addressed:

- Does the senior generation want to continue the farm?

- Does the next generation want to continue the farming operation?

- Is there a mutual agreement on what the farm will look like in the future?

- Does the next generation currently have input on decisions impacting the farm?

- Is the next generation capable and prepared to assume ownership and management of the farm when the transition occurs?

- Have you assessed the total value of the farm within the last five years?

- Have you planned for the impact that an illness or disability may have on the financial strength and operation of the farm?

- Have you thought about the effect that a marriage or divorce would have on your operation?

- What kind of income do you need for retirement and healthcare costs, and where will this come from?

Succession planning is a process

Yeo & Yeo can help farm families answer these questions and implement various succession strategies depending on the situation the family presents. One way the firm helps its clients is by partnering with Nationwide and utilizing its Land As Your Legacy® program, which is a comprehensive transition planning tool for farmers and ranchers. The key elements of the program include:

- Succession planning – determining the best way to transition the farm to the next generation

- Business planning – ensuring the future of the farm; is it economically viable for the next generation?

- Risk management – identify risks involved in global markets, weather and natural disasters, investments and the owners’ retirement and business plan, and manage potential issues now

- Financial independence – safeguarding the exiting generation with enough compensation to live on, as well as enough compensation for the succeeding generation to be stable in taking over operations

- Estate planning services – creating an organized estate in the event of a family member’s death

It is much more difficult today for children of farmers to take over the family farm. It is no longer advisable to simply plan the estate; a comprehensive succession plan that begins years before is crucial to successfully transitioning the family farm to the next generation.

Yeo & Yeo’s Agribusiness Services Group helps family farms navigate challenges and advance the goal of building a strong legacy for future generations. Please contact us for assistance.

Learn more at an Agribusiness Seminar: Managing Market Risks + Transitioning Your Family Farm

In order to help its agribusiness clients with succession planning, Yeo & Yeo is pleased to host a complimentary breakfast seminar for family farmers on Tuesday, August 30, featuring Mark Gold of Top Third Ag Marketing and Kent Creager of Nationwide. Learn More + Meet the Presenters

Yeo & Yeo is pleased to host a breakfast seminar on August 30 featuring Mark Gold of Top Third Marketing and Kent Creager of Nationwide.

Join us for breakfast on Tuesday, August 30, from 8:00 to 11:00 a.m. at Horizons Conference Center.

SUCCESS TODAY presented by Mark Gold

What’s the latest on risk management? How can farmers become better agricultural marketers of crops and livestock?

Mark Gold of Top Third Ag Marketing provides insight of the day’s market action and trends, and discusses strategies to manage risks in volatile markets. Gold is a veteran marketing expert with 20 years’ experience as a pit trader and floor broker with the Chicago Board of Trade. You’ll also recognize him as a grain analyst on the radio, AgDay TV and U.S. Farm Report.

SUCCESS TOMORROW presented by Kent Creager

Do you have the dream of passing on the family farm?

Farm equity, retirement plans, next generation financing, inheritable assets and interpersonal issues can significantly affect the transition of the family farm. Farm succession planning is essential to the process of passing a farm to the next generation as smoothly and successfully as possible. Nationwide’s Land As Your Legacy® program helps families leverage their largest asset and guides families through the critical decisions to help ensure the dream becomes reality. Land As Your Legacy® is a thorough, fee-free farm succession planning process open to any farmer. Presenter Kent Creager of Nationwide will walk us through the key steps.

Yeo & Yeo’s CPAs and wealth advisors will also share a Family Farm Update on current regulatory issues and opportunities in family farming and agribusiness today.

This complimentary seminar is ideal for family farmers and professionals who serve the agribusiness industry. Spouses, siblings and/or those directly involved in your transition plan are also encouraged to attend.

Please register by August 22, and include the names of those who will attend. Contact Terra Lewis at 989.793.9830 or terlew@yeoandyeo.com.

Click here to view the invitation to Yeo & Yeo CPAs & Business Consultants’ Agribusiness Seminar.

- An organization that files Form 990 may have its exempt status retroactively reinstated if it completes and submits an Application and pays the appropriate user fee no later than 15 months after the date of the Revocation Letter or the date the IRS posted the organization on the Revocation List, whichever is later. In addition, it must paper file the annual returns for all missing tax years. Included in the Application must be a Reasonable Cause Statement and a statement that the annual returns have been filed. The reasonable cause statement must establish the facts and circumstances with respect to its failure to file the required annual return for at least one of the three consecutive years.

- If an organization is filing for reinstatement more than 15 months after revocation, it will qualify for retroactive reinstatement if it completes and submits an Application, pays the appropriate user fee, paper files the missing annual returns, and includes a Reasonable Cause Statement and a statement that the missing annual returns have been filed with the Application. The reasonable cause statement must establish the facts and circumstances with respect to its failure to file the required annual returns for all three years that it failed to file.

- An organization can also apply for reinstatement from the post-mark date by completing and submitting an Application and paying the user fee.

For more information, please refer to the Automatic Revocation of Exemption page on the IRS website and contact your Yeo & Yeo Non-Profit professional.

About the author

Employees of most small to mid-size businesses are seen as part of the family, and business owners could never imagine that their family would steal from them. In fact, employees pose the greatest fraud threat in today’s economy. In its 2016 Report to the Nations on Occupational Fraud and Abuse, the Association of Certified Fraud Examiners states that 49% of employee fraud is committed by someone with over five years’ tenure. These employees are often the most trusted, yet the fraud they commit average over $225,000 in losses.

A business cannot grow to new heights without a strong foundation and, in order to have a strong foundation, it is necessary for a business to have thorough internal controls. It is important to understand the four cornerstones of internal controls.

1. Procedures

It is vital for businesses to have proper procedures in place. This includes a written policy that outlines who is in charge of what duties within the company, along with the expected deadlines for these duties. When determining which employees are performing specific tasks, always keep segregation of duties in mind. Segregation of duties is dividing or allocating tasks among various individuals, striving to reduce the risk of error and fraud. The three categories to separate are authorization, custody, and record keeping. Smaller businesses may have a harder time spreading duties amongst staff, but custody and record keeping should remain separate.

2. Documentation

Complete and detailed documentation plays a key role in fraud prevention and detection. For example, invoices that are pre-numbered in sequential order allow for early detection of out-of-order or abnormal invoice numbers. Recording the original invoice number along with the sales remittance number makes for accurate records and appropriate collections on receivables. It is important to have original copies of supporting documentation. All documentation and records should be reported in a timely manner to reduce the ease of fraudulent activity.

3. Security Controls

Inventory is usually one of the biggest assets on a company’s balance sheet, so it is important to keep those assets safe. Proper security controls are needed. Good physical security controls include locked doors, safes, and vaults. Strong mechanical security controls are video-monitoring systems, time clocks, alarm systems, and employee key cards. Protecting the company’s information is a necessary security control in this day and age. Make sure each employee has a separate log-in and password in order to access the company’s network.

4. Monitoring

Even with the proper internal controls in place, a business manager still needs to monitor the entire process to make sure the internal controls are operating effectively. Large companies utilize an internal audit team to make sure their internal controls are operating properly. External audits are another highly recommended monitoring function. A CPA can make sure that a company is following Generally Accepted Accounting Principles (GAAP), but the process is not designed to focus on fraud detection. If a company does not have an internal audit team, it is strongly recommended to have an internal control study performed by an external party.

Use Yeo & Yeo’s Internal Control Checklist

Are you leaving your company exposed to fraud? If employees can easily take cash, inventory or supplies, alter financial records or manipulate records of cash received or paid, you could be inadvertently increasing the risk of fraud. Review the questions on Yeo & Yeo’s Internal Control Checklist, which may indicate the likeliness of fraud in your business.

Fraud prevention and detection have a direct impact on a business’s financial health. Yeo & Yeo’s CPAs, Fraud & Forensics examiners and forensic accountants can help business owners and managers become savvier about fraud, and develop and execute strong internal controls. We can also be a valuable resource to have on your side to help safeguard critical data and investigate losses when fraud strikes.

The next step in the State of Michigan’s Personal Property Tax reform process was recently released by the Department of Treasury. Eligible Manufacturing Personal Property (EMPP) claimants now need to certify and pay the Essential Services Assessment (ESA) no later than August 15, 2016.

The electronic ESA Statement is currently available through Michigan Treasury Online (MTO) for claimants who filed and received the exemption by February 22, 2016, and for those Form 5278 filings processed during the second filing window which ended May 31, 2016.

This ESA Statement is only available online and will not be mailed to the claimant. To receive the EMPP exemption for 2016 and avoid late penalties, each taxpayer is required to certify the ESA Statement and pay the full ESA liability by August 15. Payments processed after August 15 are subject to penalties. If a certified statement and full payment, including any late payment penalties, are not received by October 15, Treasury is required to rescind the claimant’s EMPP exemption and the taxpayer will become liable for taxes to the local tax-collecting unit.

To complete a claim of the EMPP exemption through MTO, the taxpayer must:

- Log into MTO at https://mto.treasury.michigan.gov.

- Create a business relationship utilizing the FEIN and shared secret information reported on Form 5278.

- Review the system-generated statement.

- Amend the generated statement, if necessary.

- Certify and submit the statement as a return.

- Pay ESA liability in full.

Detailed instructions on how to navigate MTO, as well as additional information regarding the EMPP exemption, ESA tax, and approved electronic filing and payment methods are available on the ESA website at www.michigan.gov/esa.

If you need assistance, contact your Yeo & Yeo professional.

Yeo & Yeo CPAs & Business Consultants has been named one of Metropolitan Detroit’s 101 Best and Brightest Companies to Work For by the Michigan Business & Professional Association for the fifth consecutive year.

“We are especially honored to be recognized as one of the 101 Best and Brightest Companies to Work For because we were compared to not only prominent companies in Metropolitan Detroit, but also those in many other large Michigan cities such as Midland, Saginaw and Flint,” said Thomas O’Sullivan, managing principal of the Ann Arbor office. “Our employees enjoy an exceptional work environment – they are engaged in the work they do for our clients, have opportunities for training and professional development, and benefit from open communication. The firm also supports their commitment to community service. I am proud of Yeo & Yeo and the employees who made this award possible.”

Yeo & Yeo offers rewarding careers for individuals who have the desire and drive to grow as leaders in the accounting profession. More than 200 employees in offices throughout Michigan, including locations in Ann Arbor, Auburn Hills and Southgate, take pride in the firm’s reputation for personal service, commitment to clients and community support. Yeo & Yeo has a culture of developing future leaders through its in-house training department, professional development training and formal mentoring, while sustaining a family friendly work environment. The firm also offers an award-winning CPA certification bonus program. Yeo & Yeo is a strengths-based organization where employees benefit from collaboration across offices and teams, and have access to advisors and resources that help them succeed.

The annual competition is a program of the Michigan Business & Professional Association (MBPA) and recognizes organizations that display a commitment to excellence in their human resource practices and employee enrichment. An independent research firm scored each company’s entry based on key measures in categories such as work-life balance, compensation, employee education and development, recognition and retention, and community initiatives.

The geographic area included in the Metropolitan Detroit competition encompasses 21 counties. Companies in counties as far north as Midland, Bay and Saginaw, as far west as Clinton, Ingham and Jackson, and those in the entire Thumb and Metropolitan Detroit regions were eligible to participate. A total of 568 companies fully completed the program this year compared to 522 companies last year.

Winning companies will be honored at MBPA’s annual awards program and human resources symposium on September 23 at the Detroit Marriott at the Renaissance Center.

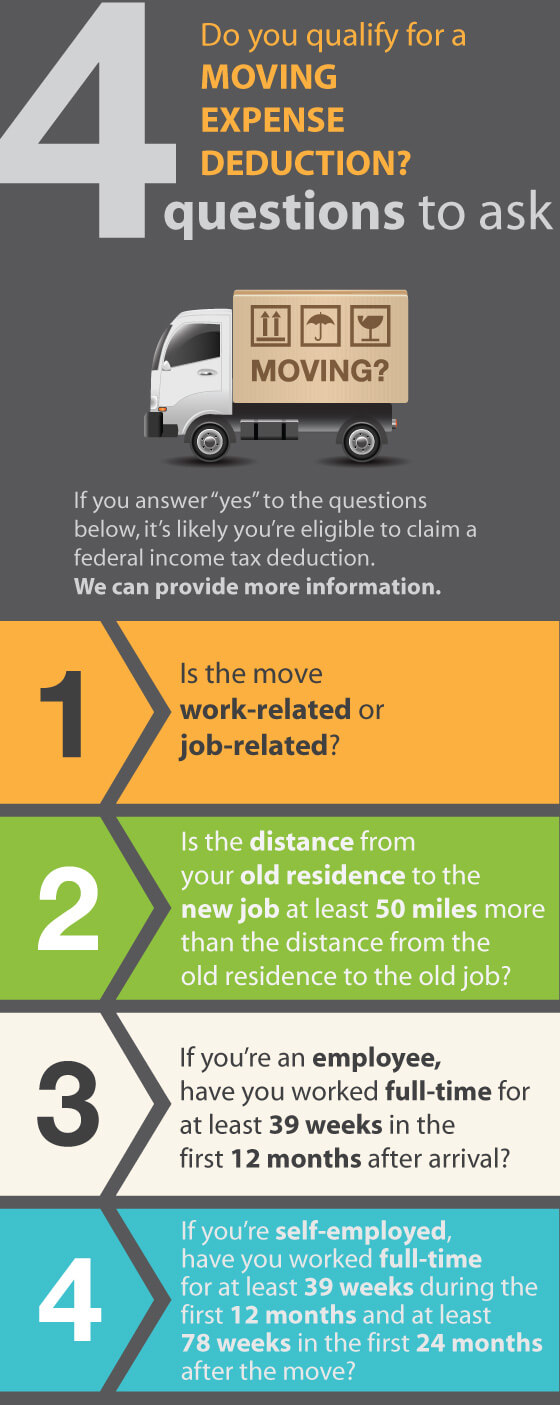

If you answer “yes” to the questions in the below infographic, it’s likely you’re eligible to claim a federal income tax deduction. Contact your Yeo & Yeo accounting professional to determine how we can help you.

The Kroger Co. will donate up to $2 million this year to nonprofit organizations. Your organization can earn a share of that donation. Here’s how:

- Go to www.kroger.com/communityrewards to register your organization by filing the Enrollment Application, Terms and Conditions and your Letter of Determination 501(c)(3).

- Then, encourage members and supporters to register their Kroger rewards card online, using your organization’s name. Whenever the individual shops using their Kroger rewards card, your organization will earn money.

Each quarter, Kroger will pay up to $500,000 to participating organizations. The payout is based on the organization’s percentage of eligible spending related to eligible spending by all participating organizations.

This simple, no-cost fundraiser is a great way for a nonprofit organization to earn additional funds. Go to www.kroger.com/communityrewards for more information and to register your organization. If you have questions, please contact your Yeo & Yeo Non-Profit professional.

For anyone who takes a spin at roulette, cries out “Bingo!” or engages in other wagering activities, it’s important to be familiar with the applicable tax rules. Otherwise, you could be putting yourself at risk for interest or penalties — or missing out on tax-saving opportunities.

Wins

You must report 100% of your wagering winnings as taxable income. The value of complimentary goodies (“comps”) provided by gambling establishments must also be included in taxable income because comps are considered gambling winnings. Winnings are subject to your regular federal income tax rate, which may be as high as 39.6%.

Amounts you win may be reported to you on IRS Form W-2G (“Certain Gambling Winnings”). In some cases, federal income tax may be withheld, too. Anytime a Form W-2G is issued, the IRS gets a copy. So if you’ve received such a form, keep in mind that the IRS will expect to see the winnings on your tax return.

Losses

You can write off wagering losses as an itemized deduction. However, allowable wagering losses are limited to your winnings for the year, and any excess losses cannot be carried over to future years. Also, out-of-pocket expenses for transportation, meals, lodging and so forth don’t count as gambling losses and, therefore, can’t be deducted.

Documentation

To claim a deduction for wagering losses, you must adequately document them, including:

- The date and type of specific wager or wagering activity.

- The name and address or location of the gambling establishment.

- The names of other persons (if any) present with you at the gambling establishment. (Obviously, this is not possible when the gambling occurs at a public venue such as a casino, race track, or bingo parlor.)

- The amount won or lost.

The IRS allows you to document income and losses from wagering on table games by recording the number of the table that you played and keeping statements showing casino credit that was issued to you. For lotteries, your wins and losses can be documented by winning statements and unredeemed tickets.

Please contact us if you have questions or want more information. If you qualify as a “professional” gambler, some of the rules are a little different.

© 2016

Under Michigan Sales/Use Tax Statutes, a casual seller, i.e., not a licensed new or used vehicle dealer, is not responsible for collecting and remitting sales tax on the sale of a used motor vehicle. Instead, the buyer is subject to Michigan use tax when registering the title with the Michigan Secretary of State office.

The Michigan Department of Treasury has established a system to cross-reference amounts reported to the Michigan Secretary of State as the sales price for a used vehicle transfer to the National Automotive Dealers Association (NADA) database for the retail value of used vehicles. Under Michigan law, the use tax payable on a used vehicle transfer is 6% on the greater of the purchase price or the retail value of the vehicle at the time of transfer.

Based on this comparison, when the reported sales price is less than the NADA value, the Michigan Treasury will send a series of notices with the intent of either supporting the reported price, or collecting the delinquent use tax. The first mailing is expected in mid-August. The notices explain the assessment process and options for supporting a value less than NADA amounts.

You can only deduct losses from an S corporation, partnership or LLC if you “materially participate” in the business. If you don’t, your losses are generally “passive” and can only be used to offset income from other passive activities. Any excess passive loss is suspended and must be carried forward to future years.

Material participation is determined based on the time you spend in a business activity. For most business owners, the issue rarely arises — you probably spend more than 40 hours working on your enterprise. However, there are situations when the IRS questions participation.

Several tests

To materially participate, you must spend time on an activity on a regular, continuous and substantial basis.

You must also generally meet one of the tests for material participation. For example, a taxpayer must:

- Work 500 hours or more during the year in the activity,

- Participate in the activity for more than 100 hours during the year, with no one else working more than the taxpayer, or

- Materially participate in the activity for any five taxable years during the 10 tax years immediately preceding the taxable year. This can apply to a business owner in the early years of retirement.

There are other situations in which you can qualify for material participation. For example, you can qualify if the business is a personal service activity (such as medicine or law). There are also situations, such as rental businesses, where it is more difficult to claim material participation. In those trades or businesses, you must work more hours and meet additional tests.

Proving your involvement

In some cases, a taxpayer does materially participate, but can’t prove it to the IRS. That’s where good recordkeeping comes in. A good, contemporaneous diary or log can forestall an IRS challenge. Log visits to customers or vendors and trips to sites and banks, as well as time spent doing Internet research. Indicate the time spent. If you’re audited, it will generally occur several years from now. Without good records, you’ll have trouble remembering everything you did.

Passive activity losses are a complicated area of the tax code. Consult with your tax adviser for more information on your situation.

© 2016

Investing in mutual funds is an easy way to diversify a portfolio, which is one reason why they’re commonly found in retirement plans such as IRAs and 401(k)s. But if you hold such funds in taxable accounts, or are considering such investments, beware of these three tax hazards:

- High turnover rates. Mutual funds with high turnover rates can create income that’s taxed at ordinary-income rates. Choosing funds that provide primarily long-term gains can save you more tax dollars because of the lower long-term rates.

- Earnings reinvestments. Earnings on mutual funds are typically reinvested, and unless you keep track of these additions and increase your basis accordingly, you may report more gain than required when you sell the fund. (Since 2012, brokerage firms have been required to track — and report to the IRS — your cost basis in mutual funds acquired during the tax year.)

- Capital gains distributions. Buying equity mutual fund shares late in the year can be costly tax-wise. Such funds often declare a large capital gains distribution at year end, which is a taxable event. If you own the shares on the distribution’s record date, you’ll be taxed on the full distribution amount even if it includes significant gains realized by the fund before you owned the shares. And you’ll pay tax on those gains in the current year — even if you reinvest the distribution.

If your mutual fund investments aren’t limited to your tax-advantaged retirement accounts, watch out for these hazards. And contact us — we can help you safely navigate them to keep your tax liability to a minimum.

© 2016

Executives and other key employees are often compensated with more than just salary, fringe benefits and bonuses: They may also be awarded stock-based compensation, such as restricted stock or stock options. Another form that’s becoming more common is restricted stock units (RSUs). If RSUs are part of your compensation package, be sure you understand the tax consequences — and a valuable tax deferral opportunity.

RSUs vs. restricted stock

RSUs are contractual rights to receive stock (or its cash value) after the award has vested. Unlike restricted stock, RSUs aren’t eligible for the Section 83(b) election that can allow ordinary income to be converted into capital gains.

But RSUs do offer a limited ability to defer income taxes: Unlike restricted stock, which becomes taxable immediately upon vesting, RSUs aren’t taxable until the employee actually receives the stock.

Tax deferral

Rather than having the stock delivered immediately upon vesting, you may be able to arrange with your employer to delay delivery. This will defer income tax and may allow you to reduce or avoid exposure to the additional 0.9% Medicare tax (because the RSUs are treated as FICA income).

However, any income deferral must satisfy the strict requirements of Internal Revenue Code Section 409A.

Complex rules

If RSUs — or other types of stock-based awards — are part of your compensation package, please contact us. The rules are complex, and careful tax planning is critical.

© 2016