Manager Spotlight: Get to Know Derrick Friend

Derrick Friend, CPA, was recently promoted to manager. Let’s learn about Derrick and how his career has progressed since joining Yeo & Yeo.

Tell me about your career path.

I joined the firm in 2016 after returning to school for my master’s degree. I was immediately given opportunities to prepare a wide variety of tax returns and received a great amount of on-the-job training. Over the next few years, I narrowed my niche to state and local tax and 1040 returns. Two years ago, I joined the 1040 tax group, where I specialize in reviewing a high volume of individual tax returns.

What do you enjoy most about your career with Yeo & Yeo?

The people at Yeo & Yeo are great to work with. My mentors and peers have helped me grow my knowledge and career. I enjoy working with clients, too, and helping them navigate their unique tax situations.

How has the firm supported your work-life presence?

Yeo & Yeo provides a very flexible work schedule, even during the busy season. The Hybrid Work Plan, allowing for days to work from home, has been a huge benefit to our family. It makes raising four kids with a working spouse a lot less stressful.

What advice would you give to an aspiring accountant progressing in their career?

Take advantage of the opportunities provided to you and get a feel for what you enjoy doing, then focus on that as your career progresses.

What makes being an accountant fun?

A tax return is like a puzzle, and it’s oddly satisfying when you get all the pieces together. Plus, I like helping people save money through tax-smart strategies.

Derrick specializes in tax planning and preparation with an emphasis on individual taxes. He holds a Master of Accountancy from Walsh College. He joined the firm in 2016 and is based in the Auburn Hills office. In the community, Derrick volunteers at Linden Community Schools.

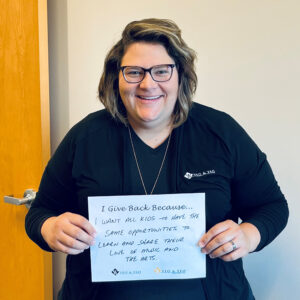

Major Chords for Minors (MCFM) was created and founded to provide one-on-one music lessons on piano, guitar and drums to at-risk kids whose families cannot afford to give their children lessons. Their mission is to build better children through music and create a community where all children have access to growth through music and mentorship, regardless of their families’ economic circumstances. The program also has a performance band that plays at various events throughout the community, including Party on McCarty, the Saginaw Art Fair, and Friday Night Live.

I love music and playing music. I have been a band kid since middle school and play clarinet, guitar, drums, piano and accordion. I think that being in band gave me a sense of belonging in school and taught me the value of having to practice something to get better at it. When I heard about the opportunity to join the board of MCFM, I decided to get involved. I loved the organization’s mission and purpose. Playing an instrument is expensive so having the opportunity to have free lessons is incredible.

I love music and playing music. I have been a band kid since middle school and play clarinet, guitar, drums, piano and accordion. I think that being in band gave me a sense of belonging in school and taught me the value of having to practice something to get better at it. When I heard about the opportunity to join the board of MCFM, I decided to get involved. I loved the organization’s mission and purpose. Playing an instrument is expensive so having the opportunity to have free lessons is incredible.

I joined the organization in April 2021, and I am the current board treasurer. Seeing the dedication of the founders, director, instructors and support staff is amazing. They all have a great passion for music but also want to see kids be successful and have the opportunity to grow through music.

I give back because I want all kids to have the same opportunities to learn and share their love of music and the arts.

The Social Security Administration recently announced that the wage base for computing Social Security tax will increase to $160,200 for 2023 (up from $147,000 for 2022). Wages and self-employment income above this threshold aren’t subject to Social Security tax.

Basics about Social Security

The Federal Insurance Contributions Act (FICA) imposes two taxes on employers, employees and self-employed workers. One is for the Old Age, Survivors and Disability Insurance program, which is commonly known as Social Security. The other is for the Hospital Insurance program, which is commonly known as Medicare.

There’s a maximum amount of compensation subject to the Social Security tax, but no maximum for Medicare tax. For 2023, the FICA tax rate for employers is 7.65% — 6.2% for Social Security and 1.45% for Medicare (the same as in 2022).

2023 updates

For 2023, an employee will pay:

- 6.2% Social Security tax on the first $160,200 of wages (6.2% of $160,200 makes the maximum tax $9,932.40), plus

- 1.45% Medicare tax on the first $200,000 of wages ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return), plus

- 2.35% Medicare tax (regular 1.45% Medicare tax plus 0.9% additional Medicare tax) on all wages in excess of $200,000 ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return).

For 2023, the self-employment tax imposed on self-employed people is:

- 12.4% Social Security tax on the first $160,200 of self-employment income, for a maximum tax of $19,864.80 (12.4% of $160,200), plus

- 2.9% Medicare tax on the first $200,000 of self-employment income ($250,000 of combined self-employment income on a joint return, $125,000 on a return of a married individual filing separately), plus

- 3.8% (2.9% regular Medicare tax plus 0.9% additional Medicare tax) on all self-employment income in excess of $200,000 ($250,000 of combined self-employment income on a joint return, $125,000 for married taxpayers filing a separate return).

Employees with more than one employer

What happens if one of your employees works for your business and has a second job? That employee would have taxes withheld from two different employers. Can the employee ask you to stop withholding Social Security tax once he or she reaches the wage base threshold? Unfortunately, no. Each employer must withhold Social Security taxes from the individual’s wages, even if the combined withholding exceeds the maximum amount that can be imposed for the year. Fortunately, the employee will get a credit on his or her tax return for any excess withheld.

Looking forward

Contact us if you have questions about 2023 payroll tax filing or payments. We can help ensure you stay in compliance.

© 2022

One of the best ways to tackle financial statement fraud is to conduct periodic surprise audits. In fact, surprise audits were associated with at least a 50% reduction in both median loss and median duration, according to Occupational Fraud 2022: A Report to the Nations published by the Association of Certified Fraud Examiners (ACFE) earlier this year.

Surprisingly, however, less than half of respondents (42%) conduct surprise audits. So, numerous organizations have an opportunity to add this highly effective tool to their antifraud arsenal.

Cost of financial misstatement

Financial statement fraud happens when “an employee intentionally causes a misstatement or omission of material information in the organization’s financial reports.” Examples include a salesperson who prematurely reports sales to boost commissions or a controller who books fictitious revenue to hide theft — or lackluster financial performance.

These types of schemes can be costly. The ACFE’s survey found that the median loss from misstated financial results is roughly $593,000.

Element of surprise

Routine financial statement audits don’t provide an absolute guarantee against financial misstatement and other fraud schemes. In fact, external audits were the primary detection method in just 4% of the cases reported in the ACFE study. Although a financial statement audit serves as a vital role in corporate governance, the ACFE advises that it shouldn’t be relied upon as an organization’s primary antifraud mechanism.

By comparison, a surprise audit more closely examines the company’s internal controls that are intended to prevent and detect fraud. Here, auditors aim to identify any weaknesses that could make assets vulnerable and to determine whether anyone has already exploited those weaknesses to misappropriate assets. Auditors show up unexpectedly — usually when the owners suspect foul play, or randomly as part of the company’s antifraud policies — to review cash accounts, bank statements, expense reports, payroll, purchasing, sales and other areas for suspicious activity.

The element of surprise is critical. Announcing an upcoming audit gives wrongdoers time to cover their tracks by shredding (or creating false) documents, altering records or financial statements, or hiding evidence.

Perpetrators are likely to have paid close attention to how previous financial statement audits were performed — including the order in which the auditor proceeded. But, in a surprise audit, the auditor might follow a different process or schedule. For example, instead of beginning audit procedures with cash, the auditor might first scrutinize receivables or vendor invoices. Surprise audits focus particularly on high-risk areas such as inventory, receivables and sales. In the course of performing them, auditors typically use technology to conduct sampling and data analysis.

Big benefits

In the ACFE survey, the median loss for organizations that conducted surprise audits was $75,000, compared with a median loss of $150,000 for those organizations that didn’t perform this measure — a 50% difference. This discrepancy is no surprise in light of how much longer fraud schemes went undetected in organizations that failed to conduct surprise audits. The median duration in those organizations was 18 months, compared with only nine months for organizations that performed surprise audits.

Such audits can have a strong deterrent effect as well. While surprise audits, by definition, aren’t announced ahead of time, companies should state in their fraud policies that random tests will be conducted to ensure internal controls aren’t being circumvented. If this isn’t enough to deter would-be thieves or convince current perpetrators to abandon their schemes, simply seeing guilty co-workers get swept up in a surprise audit should do the trick.

Additional investigation

As with financial statement audits, an auditor’s finding of suspicious activity in a surprise audit will likely require additional forensic investigation. Depending on the type of scheme, an auditor might conduct interviews with suspects and possible witnesses, scour financial statements and records, and perform in-depth data analysis to get to the bottom of the matter. Contact us to schedule a surprise audit for your organization.

© 2022

On October 13, the U.S. Department of Labor (DOL) published a proposed rule to revise existing guidance on how to determine whether a worker is an employee or independent contractor under the Fair Labor Standards Act (FLSA).

The DOL intends to rescind an earlier rule and replace it with an analysis for determining employee vs. independent contractor status that’s more consistent with the FLSA as interpreted by longstanding judicial precedent.

Earlier rule

The earlier rule was published on January 7, 2021, by the DOL under the Trump administration. It addressed the distinction between employees and independent contractors under the FLSA using two core factors of the economic realities test:

- The nature and degree of the worker’s control over the work, and

- The worker’s opportunity for profit or loss based on initiative and/or investment.

Under the 2021 rule — which took effect on March 8, 2021, and remains in effect — these factors weigh more than other considerations when determining whether a worker is an employee or independent contractor.

Opponents have argued that the 2021 rule runs counter to established court rulings on the matter. The DOL under the current Biden administration issued rules in 2021 to delay and withdraw the rule, but they were vacated by a federal district court on March 14, 2022.

Proposed rule

The DOL said that its newly proposed rule would reduce the risk that employees are misclassified as independent contractors and provide added certainty for employers that hire independent contractors or might consider doing so.

The agency further stated that it issued the proposed rule because it believes the 2021 rule doesn’t fully comport with the FLSA’s text and purpose as interpreted by courts, and it departs from decades of case law applying the “economic reality” test.

The proposed rule, according to the DOL, doesn’t use the two core factors. Rather, it aims to return to a “totality of the circumstances” analysis of the economic reality test. Under this analysis, the factors don’t have a predetermined weight and are considered in view of the economic reality of the whole activity.

Thereby, the proposed rule provides multiple factors to be considered when determining worker status. These include:

- Whether investments by a worker are capital or entrepreneurial in nature,

- The nature and degree of control an employer has over the working relationship, and

- Whether work performed is an integral part of the employer’s operations.

The DOL notes that no single factor under the proposed rule will be dispositive, and additional factors may be considered.

Opposition rising

Interested parties have until November 28, 2022, to submit comments on the proposed rule. As of this writing, several business groups — including the National Retail Federation and the National Association of Home Builders — have voiced opposition to it. They’ve cited issues such as the likelihood of “endless litigation,” insufficient time to retrain HR staff and lack of clarity in the rule itself. Contact us for further information on employee classification and help with compliance.

© 2022

There’s no shortage of online do-it-yourself (DIY) tools that promise to help you create an “estate plan.” But while these tools can generate wills, trusts and other documents relatively cheaply, they can be risky except in the simplest cases. If your estate is modest in size, your assets are in your name alone, and you plan to leave them to your spouse or other closest surviving family member, then using an online service may be a cost-effective option. Anything more complex can expose you to a variety of costly pitfalls.

Your plan’s details count

Part of the problem is that online services can help you create individual documents — the good ones can even help you comply with applicable laws, such as ensuring the right number of witnesses to your will — but they can’t help you create an estate plan. Putting together a plan means determining your objectives and coordinating a collection of carefully drafted documents designed to achieve those objectives. And in most cases, that requires professional guidance.

For example, let’s suppose Ken’s estate consists of a home valued at $500,000 and a mutual fund with a $500,000 balance. He uses a DIY tool to create a will that leaves the home to his daughter and the mutual fund to his son. It seems like a fair arrangement. But suppose that by the time Ken dies, he’s sold the home and invested the proceeds in his mutual fund. Unless he amended his will, he will disinherit his daughter. An experienced estate planning advisor would have anticipated such contingencies and ensured that Ken’s plan treated both children fairly, regardless of the specific assets in his estate.

Professional experience vs. technical expertise

DIY tools also fall short when a decision demands a professional’s experience rather than mere technical expertise. An online service makes it easy to name a guardian for your minor children, for example, but it can’t help you evaluate the many characteristics and factors that go into selecting the best candidate.

We’d be pleased to help answer any of your estate planning questions and to help draft your documents.

© 2022

Yeo & Yeo is pleased to announce the promotion of three professionals.

Shannon Champagne, CPA, has been promoted to Manager. She is a member of the firm’s Nonprofit Services Group. Her areas of expertise include audits for nonprofits, school districts and healthcare organizations. Champagne holds a Bachelor in Professional Accountancy from Saginaw Valley State University. She is a member of the Saginaw Young Professionals Network and Women in Leadership Great Lakes Bay Region. She is based in the firm’s Saginaw office. As a member of the firm’s Assurance Service Line, Champagne enjoys meeting different clients and guiding them through the audit process.

Derrick Friend, CPA, has been promoted to Manager. He specializes in tax planning and preparation with an emphasis on individual taxes and holds a Master of Accountancy from Walsh College. He joined the firm in 2016 and is based in the Auburn Hills office. In the community, Friend volunteers at Linden Community Schools. As a member of the firm’s Tax Service Line, he enjoys helping clients save money through tax-smart strategies.

Roselynn Sharman has been promoted to Outsourced Business Operations Manager. Her areas of expertise include business advisory services, outsourced accounting and payroll tax reporting. She is a member of the Valley Society of Human Resources Management. In the community, she serves as board treasurer of Major Cords for Minors and board treasurer for the Lutheran Women’s Missionary League at St. Lorenz Lutheran Church. Sharman enjoys that not a single day is the same in accounting, and she appreciates having a variety of projects to work on and clients to serve. She is based in the firm’s Saginaw office.

When a company’s leadership engages in strategic planning, growing the business is typically at the top of the agenda. This is as it should be — ambition is part and parcel of being a successful business owner. What’s more, in many industries, failing to grow could leave the company at the mercy of competitors.

However, unbridled growth can be a dangerous thing. A business that expands too quickly can soon run out of working capital. And the very leaders who pushed the business to grow beyond its means might find themselves spread too thin and burned out.

That’s why, as your company lays out its strategic plans for the coming year(s), it’s important to focus on manageable growth.

A common scenario

Among the biggest challenges that many “high-growth” businesses face is finding enough financing for their expansion plans. Their owners often think, “If we want to double sales, we’ve got to double assets.” Buying equipment, hardware, software, raw materials and other assets usually requires debt or equity financing — which can be good for a lender but perilous for a borrower.

Overzealous asset acquisition strategies can cause repayment problems if cash flow projections fall short. There’s often a delay between:

- When a growing company buys inventory, makes products or provides services, and pays employees (cash outflows), and

- When it receives customer payments (cash inflows).

The faster the growth, the bigger the gap. Businesses typically fund the shortfall with a credit line. And as they take on more and more debt, loan repayments can eventually consume most or even all the company’s cash flows.

Warning signs

It’s easy to get swept up in the whirlwind of rapid growth, but it’s not inevitable. You and your leadership team can watch for common warning signs that you may be at risk of becoming a victim of your own success. These include:

An increasing debt-to-equity ratio. High-growth businesses tend to burn through cash at an alarming rate, if given the opportunity. If your strategic plan will likely drive you to consume an entire credit line, and then ask for more, watch out. Closely monitor your ratio of debt to equity. A consistent upward trend is cause for concern — even if it’s within loan restrictions.

Quickly declining profit margins. Leadership teams overly obsessed with growth tend to focus on the top line and lose sight of expenses. Low prices and an undisciplined approach to taking on any and every customer can further erode profits.

Rising complaints. High-growth companies are often inclined to overlook quality control and fall short on backend obligations, such as warranties and customer service. This typically leads to customer complaints. Meanwhile, cash shortfalls may lead to delayed payments to vendors and lenders. At some point, these parties will likely start complaining as well.

Do the managing

Make no mistake: growing your business is an important and, in many cases, necessary goal. But if you don’t manage that growth, it could manage you — into a crisis. Contact us for help building reasonable financial objectives into your strategic planning process.

© 2022

Mitigating the adverse effects of climate change is one of the primary targets of the recently enacted Inflation Reduction Act (IRA). To that end, the legislation is packed with tax incentives, including the significant expansion and extension of two tax deductions for energy-efficient construction. The changes to the Section 179D deduction for commercial buildings and the Section 45L credit for residential homes increase their potential value and make them available to more taxpayers than ever before.

Sec. 179D deduction

The Sec. 179D deduction has been around since 2006 but was made permanent only recently, by the Consolidated Appropriations Act. The IRA adds changes that substantially boost the size of the potential deduction and expand the pool of eligible taxpayers.

Pre-IRA, the deduction generally was limited to the owners of commercial properties or residential properties that are four stories or higher. The deduction also could be assigned to “designers” (including architects and engineers) of buildings owned by government entities.

To claim the deduction, a taxpayer was required to show a 50% reduction in energy and power costs. The deduction amount was up to 63 cents per square foot for each of three eligible systems (HVAC and hot water, interior lighting and building envelope). The maximum deduction was $1.88 per square foot (adjusted for inflation). Taxpayers could get a partial deduction if they couldn’t show the requisite savings in all three systems and the deduction could be claimed only once per property.

The IRA keeps these requirements intact for the remainder of 2022 but makes some major changes starting on January 1, 2023. For starters, the qualification threshold drops to 25% energy savings, with a base deduction of 50 cents per square foot.

If, however, the project satisfies prevailing wage and apprenticeship requirements for laborers and mechanics, you can qualify for the so-called “bonus” deduction of up to $2.50 per square foot. This deduction amount increases on a sliding scale:

- If you qualify for the bonus, your deduction increases by 10 cents for each percentage point of energy savings above 25%, up to a 50% reduction, maxing out at $5 per square foot.

- If you don’t qualify for the bonus, your deduction increases by 2 cents for each percentage point of energy savings beyond 25%, again up to 50%, for a maximum deduction of $1 per square foot.

The IRA brings other changes, too. For example, it eliminates the availability of partial deductions, and it allows all tax-exempt entities — not just government entities — to assign their deductions to designers.

The law also revises the standard for determining the amount of energy savings. Currently, the determination is made using the American Society of Heating, Refrigerating and Air-Conditioning Engineers (ASHRAE) standard in effect two years prior to the start of the construction. Under the IRA, energy savings will be evaluated under the ASHRAE standard from four years prior to completion of construction.

In addition, the deduction is no longer “one and out.” You can claim it again every three tax years (four years for buildings that are owned by government or tax-exempt entities) for subsequent energy-efficient improvements.

And the IRA creates a new alternative deduction path for renovation projects. To be eligible, you must have a qualified retrofit plan and reduce the building’s energy use “intensity” by at least 25% (as opposed to annual energy and power costs) compared to before the retrofit. Qualifying taxpayers can claim the retrofit credit in the qualifying final certification year. The deduction amount can’t exceed the total adjusted basis of the retrofit property placed in service.

Sec. 45L credit

The Sec. 45L credit also first became available in 2006, but it expired at the end of 2021. The credit applied to “eligible contractors” that built energy-efficient single-family, manufactured and low-rise multifamily residences. To qualify, the residences had to be 50% more energy-efficient than a standard dwelling unit that complies with the 2006 International Energy Conservation Code standards. The maximum credit was $2,000 per unit, with no partial credit permitted.

The IRA revived the Sec. 45L credit, extending it in its original form for qualifying buildings placed in service in 2022, with the same eligibility requirements and credit amount. Beginning in 2023 and running through 2032, though, the credit will be available for residential properties of any size, including those that exceed three floors. This means that multifamily properties that are four or more floors will be able to qualify for both 179D and 45L.

However, the IRA imposes more stringent standards for determining energy savings. Properties must satisfy the U.S. Department of Energy’s Energy Star Manufactured New Homes Program or Energy Star Residential New Construction Program requirements.

The base credit amount changes in 2023, too. It increases to $2,500 per unit for single-family Energy Star homes and falls to only $500 per unit for Energy Star multifamily homes. But taxpayers might qualify for much larger credits by fulfilling additional criteria.

If a property meets the requirements for the even stricter Zero Energy Ready Home program, the credit jumps to $5,000 per single-family unit and $1,000 per unit for multifamily homes. The credit for an Energy Star multifamily property goes up to $2,500 per unit if the property satisfies prevailing wage requirements, or $5,000 per unit if it’s also Zero Energy Ready.

Make the most of the IRA

The Sec. 179D and 45L incentives are only the tip of the iceberg when it comes to the IRA’s energy-related tax provisions affecting both personal and business property. We can help you leverage all of the applicable opportunities to minimize your federal tax liability.

© 2022

Businesses can provide benefits to employees that don’t cost them much or anything at all. However, in some cases, employees may have to pay tax on the value of these benefits.

Here are examples of two types of benefits which employees generally can exclude from income:

- A no-additional-cost benefit. This involves a service provided to employees that doesn’t impose any substantial additional cost on the employer. These services often occur in industries with excess capacity. For example, a hotel might allow employees to stay in vacant rooms or a golf course may allow employees to play during slow times.

- A de minimis fringe benefit. This includes property or a service, provided infrequently by an employer to employees, with a value so small that accounting for it is unreasonable or administratively impracticable. Examples are coffee, the personal use of a copier or meals provided occasionally to employees working overtime.

However, many fringe benefits are taxable, meaning they’re included in the employees’ wages and reported on Form W-2. Unless an exception applies, these benefits are subject to federal income tax withholding, Social Security (unless the employee has already reached the year’s wage base limit) and Medicare.

Court case provides lessons

The line between taxable and nontaxable fringe benefits may not be clear. As illustrated in one recent case, some taxpayers get into trouble if they cross too far over the line.

A retired airline pilot received free stand-by airline tickets from his former employer for himself, his spouse, his daughter and two other adult relatives. The value of the tickets provided to the adult relatives was valued $5,478. The airline reported this amount as income paid to the retired pilot on Form 1099-MISC, which it filed with the IRS. The taxpayer and his spouse filed a joint tax return for the year in question but didn’t include the value of the free tickets in gross income.

The IRS determined that the couple was required to include the value of the airline tickets provided to their adult relatives in their gross income. The retired pilot argued the value of the tickets should be excluded as a de minimis fringe.

The U.S. Tax Court agreed with the IRS that the taxpayers were required to include in gross income the value of airline tickets provided to their adult relatives. The value, the court stated, didn’t qualify for exclusion as a no-additional-cost service because the adult relatives weren’t the taxpayers’ dependent children. In addition, the value wasn’t excludable under the tax code as a de minimis fringe benefit “because the tickets had a value high enough that accounting for their provision was not unreasonable or administratively impracticable.” (TC Memo 2022-36)

You may be able to exclude from wages the value of certain fringe benefits that your business provides to employees. But the requirements are strict. If you have questions about the tax implications of fringe benefits, contact us.

© 2022

What do you do with your financial statements when your auditor delivers them? Resist the temptation to just file them away — they’re more than an exercise in compliance. With a little finagling, you can calculate key financial ratios from line items in your company’s financial statements. These metrics provide insight into historical trends, potential areas for improvement and how the business is likely to perform in the future.

Financial ratios are generally grouped into the following four principal categories:

1. Operating

Operating ratios — such as the gross margin or earnings per share — evaluate management’s performance and the effects of economic and industry forces. Operating ratios can illustrate how efficiently a company is controlling costs, generating sales and profits, and converting revenue to cash.

This analysis shouldn’t stop at the top and bottom of the income statement. Often, it’s useful to look at individual line items, such as returns, rent, payroll, owners’ compensation, interest and depreciation expense.

2. Asset management

Asset management ratios gauge liquidity, which refers to the ability of a company to meet current obligations. Commonly used liquidity ratios include:

- Current ratio, or the ratio of current assets to current liabilities,

- Quick ratio, which only considers assets that can be readily liquidated, such as cash and accounts receivable,

- Days in receivables outstanding, which estimates the average collection period for credit sales, and

- Days in inventory, which estimates the average time it takes to sell a unit of inventory.

It’s also important to consider long-term assets, such as equipment, with the total asset turnover. This ratio tells how many dollars in revenue a company generates from each dollar invested in assets. Management must walk a fine line with 1) efficient asset management, which aims to minimize the amount of working capital and other assets on hand, and 2) satisfying customers and suppliers, which calls for flexible credit terms, ample safety stock and quick bill payment.

3. Coverage

Coverage ratios measure a company’s capacity to service its debt. One commonly used coverage ratio is times interest earned, which measures a firm’s ability to meet interest payments and indicates its capacity to take on additional debt. Another is current debt coverage, which can be used to measure a company’s ability to repay its current debt.

Before a company that already has significant bank debt seeks further financing, it should calculate its coverage ratios. Then it should consider what message management sends to potential lenders.

4. Leverage

Leverage ratios can indicate a company’s long-term solvency. The long-term debt-to-equity ratio represents how much debt is funding company assets.

For example, a long-term debt-to-equity ratio of five-to-one indicates that the company requires significant debt financing to run operations. This may translate into lower returns for shareholders and higher default risk for creditors. And, because the company needs to make considerable interest payments, it has less cash to meet its current obligations.

Basis of comparison

Ratios mean little without appropriate benchmarks. Comparing a company to its competitors, industry averages and its own historical performance provides perspective on its current financial health. Contact us to help select relevant ratios to include in your analysis. We can help you create a scorecard from your year-end financial statements that your in-house accounting team can recreate throughout the year using preliminary financial numbers.

© 2022

Because the federal gift and estate tax exemption amount currently is $12.06 million, fewer people need life insurance to provide their families with the liquidity to pay estate taxes. But life insurance can still play an important part in your estate plan, particularly in conjunction with charitable remainder trusts (CRTs) and other charitable giving strategies.

Home for highly appreciated assets

CRTs are irrevocable trusts that work like this: You contribute property to a CRT during your life or upon your death and the trust makes annual distributions to you or your beneficiary (typically, your spouse) for a specified period of time. When that period ends, the remainder goes to a charity of your choice.

These instruments may be useful when you contribute highly appreciated assets, such as stock or real estate, and want to reduce capital gains tax exposure. Because the CRT is tax-exempt, it can sell the assets and reinvest the proceeds without currently triggering the entire capital gain. Another benefit is that, if you opt to receive annual distributions from your trust, that income stream generally will be taxed at a lower rate than other income using a formula that combines ordinary taxable income, tax-exempt income, capital gains and other rates.

Here’s where life insurance comes in. Because CRT assets eventually go to charity — usually after both you and your spouse have died — you won’t have as much to leave to your children or other heirs. A life insurance policy can replace that “lost” wealth in a tax advantaged way.

Charities as beneficiaries

CRTs are ideal for philanthropically minded individuals. But there are other ways to use life insurance to fund charitable gifts and enjoy tax benefits. You might, for example, transfer your policy to a nonprofit organization and take a charitable income tax deduction (subject to certain limitations) for it. If you continue to pay premiums on the policy after the charity becomes its owner and beneficiary, you can take additional charitable deductions.

Another scenario is to just name a charity as your policy’s beneficiary. Because you retain ownership, you can’t take charitable income tax deductions during your life. But when you die, your estate will be entitled to an estate tax charitable deduction.

Wealth replacement tool

Life insurance can be used to replace wealth in many circumstances — not only when you’re donating to charity. For instance, if you’ve decided to forgo long term care (LTC) insurance and pay any LTC-related expenses (such as home nursing services or care in a nursing facility) out of pocket, you may not have as much to leave your heirs. Life insurance can help ensure that you provide your family with an inheritance.

Multiple benefits

Federal estate tax liability may no longer be a concern if your estate is valued at less than $12.06 million. But, depending on your goals, life insurance can help you make charitable gifts, leave money to your heirs and realize tax advantages. We can explain the types of policies that might be appropriate for estate planning purposes.

© 2022

Is your manufacturing company on the cutting edge? It’s important to keep pace with the competition, especially if you’re trying to carve out a niche in a new marketplace. Fortunately, federal tax law allows manufacturers to claim a generous tax credit for qualified research expenses. The credit generally offsets income tax liability on a dollar-for-dollar basis.

Now there’s some extra tax incentive: The Inflation Reduction Act (IRA) expands the ability of qualified small businesses to use research credits to offset federal payroll tax instead of income tax.

The pre-IRA credit

The research credit is intended to encourage spending on research activities by both established firms and start-up companies. Generally, the credit equals the sum of 20% of the excess of qualified research expenses for the year over a base amount. (Other special rules may apply.)

For this purpose, the base amount is a fixed-base percentage (not to exceed 16%) of average annual receipts from a U.S. trade or business, net of returns and allowances, for the four years prior to the year of claiming the credit. It can’t be less than 50% of the annual qualified research expenses. In other words, the minimum credit is equal to 10% of qualified research expenses (50% rule x 20% credit).

Alternatively, a manufacturing company can claim a “simplified credit” of 14% of the amount by which its qualified research expenses for the year exceed 50% of its average qualified research expenses for the preceding three tax years.

The credit is available only for qualified expenses. The expenses must:

- Meet the definition of a “research and experimentation expenditure” established by the tax code, and

- Relate to research undertaken for the purpose of discovering information that’s technological in nature and the application of which is intended to be useful in developing a new or improved business component.

Also, substantially all of the activities of the research must constitute elements of a process of experimentation that relates to a new function or improved performance, reliability or quality.

Special payroll tax offset

Initially, the research credit was intended to offset only income tax liability. However, the Protecting Americans from Tax Hikes (PATH) Act created an alternate scenario. For tax years beginning after 2015, a qualified small business can use the credit to offset its employer share of the Social Security, or FICA, tax up to an annual limit of $250,000. This is beneficial for businesses that are just getting off the ground and have little or no taxable income.

To qualify as a small business, a manufacturer must have less than $5 million in annual gross receipts (annualized over 12 months for a business that started in the current year). Furthermore, the business can have had gross receipts for only the last five years. Thus, in effect, a business just starting can claim the payroll tax offset for a maximum of five years. Under interim guidance from the IRS, “gross receipts” are defined as the sum of total sales, amounts received for services and income from investments (including interest income).

The IRA expansion

The IRA authorizes an offset for a qualified small business against the 1.45% Medicare portion of federal payroll tax, up to an annual limit of $250,000. When combined with the PATH Act provision, this gives manufacturers the potential for a total maximum payroll offset of $500,000.

For 2022, the employer share of the Social Security tax is equal to 6.2% of an employee’s wages up to a base amount of $147,000. In contrast, the 1.45% Medicare tax portion applies to all wages. So even though it’s only at 1.45% tax, the ability to offset against Medicare tax could provide significant tax savings.

Bear in mind that this provision isn’t effective until tax years beginning after 2022. You’ll have to wait until you file your company’s 2023 tax return — in 2024 — before you can take advantage of the full offset.

Also, the credit can’t exceed the tax imposed for any calendar quarter, with any unused amounts of the credit being carried forward. Some start-up firms with small staffs may have to realize their 2023 tax benefits over the course of several years.

Moving forward

Manufacturers could benefit from the research credit by carefully navigating these basic rules. And now the IRA opens up more favorable tax opportunities to smaller manufacturers. The IRS is expected to issue guidance on the expanded research credit, as well as revised tax forms for 2023. If you have questions, contact us. We can help your manufacturing company maximize the tax benefits available for qualified research activities.

© 2022

In most companies, employees need a user identity to access work-related hardware and software. Privileges to use certain applications or open certain files usually are provided to workers based on their department, role and level of authority. Over their tenure, employees might accumulate various privileges they no longer need. For example, someone who once worked in accounting might retain the ability to make journal entries even after transferring to the legal department. Unfortunately, dishonest employees could use their privileges for nefarious purposes.

Best practices

Privileged users sometimes use their access to perpetrate fraud, intellectual property theft or sabotage. And they don’t always act alone. Third parties, such as competitors, could try to recruit privileged users to steal trade secrets. Or employees could collude with hackers to compromise a company’s network.

To prevent such incidents, your organization needs to keep close tabs on employee access. Follow these best practices:

Identify the privileges needed for each role. List the access privileges required for each job and review current employee access to ensure workers have only the privileges they need. If in doubt regarding the need for access to certain applications, err on the side of caution and remove them. Managers can reinstate privileges on a case-by-case basis if they decide someone needs greater access.

Monitor user activity. Observe how employees use their privileges. If, for example, an employee accesses customer data from another city, check to see if there’s a business reason for doing so. If someone in sales creates a journal entry, find out whether that task falls within his or her current role and if a manager has approved it.

Establish an “upgrading” process. Although managers should make any decisions about upgrading an employee’s privileges, use technology to help standardize and track requests and approvals. For sensitive applications, such as those that house customer and financial data, consider requiring two levels of approval to elevate a user’s privileges.

Remove dormant accounts. When employees leave your organization, their access privileges should be deleted immediately. If a previously inactive account becomes active, block access until you have time to research why it has come back to life.

Potentially severe consequences

If employees or third parties abuse privileged access to your network, the consequences could be severe and long-lasting. Your organization must continually monitor privileges to ensure they’re used only to perform legitimate work. Contact us to discuss fraud-proofing your network and business.

© 2022

Growing up, I had a mentor through Youth for Christ. He had a huge impact on my life and is still someone I can go to today. I wanted to be a similar resource for students, so when I moved to Mount Pleasant for college, I started volunteering for Central Michigan Youth for Christ (CMYFC), and I’ve been a mentor for roughly seven years.

Once a week during the school year, I volunteer with high school students. We meet up and play games and discuss how their school and family life is going. As a CPA, I’ve been able to help students answer personal finance questions. I’ve also helped some fill out their application for Federal Student Aid and file tax returns. It’s really rewarding to teach kids and help empower them.

Once a week during the school year, I volunteer with high school students. We meet up and play games and discuss how their school and family life is going. As a CPA, I’ve been able to help students answer personal finance questions. I’ve also helped some fill out their application for Federal Student Aid and file tax returns. It’s really rewarding to teach kids and help empower them.

Especially today, I think it is increasingly easy for people to isolate themselves, which is why organizations like CMYFC are so important. They give kids resources and people who can help them by providing a listening ear and advice. Everyone who volunteers through CMYFC goes above and beyond to care for the students so they can feel loved and seen. It is a great organization to be a part of.

I give back because I want to help students feel loved and seen.

You and your small business are likely to incur a variety of local transportation costs each year. There are various tax implications for these expenses.

First, what is “local transportation?” It refers to travel in which you aren’t away from your tax home (the city or general area in which your main place of business is located) long enough to require sleep or rest. Different rules apply if you’re away from your tax home for significantly more than an ordinary workday and you need sleep or rest in order to do your work.

Costs of traveling to your work location

The most important feature of the local transportation rules is that your commuting costs aren’t deductible. In other words, the fare you pay or the miles you drive simply to get to work and home again are personal and not business miles. Therefore, no deduction is available. This is the case even if you work during the commute (for example, via a cell phone, or by performing business-related tasks while on the subway).

An exception applies for commuting to a temporary work location that’s outside of the metropolitan area in which you live and normally work. “Temporary,” for this purpose, means a location where your work is realistically expected to last (and does in fact last) for no more than a year.

Costs of traveling from work location to other sites

On the other hand, once you get to the work location, the cost of any local trips you take for business purposes is a deductible business expense. So, for example, the cost of travel from your office to visit a customer or pick up supplies is deductible. Similarly, if you have two business locations, the costs of traveling between them is deductible.

Recordkeeping

If your deductible trip is by taxi or public transportation, save a receipt if possible or make a notation of the expense in a logbook. Record the date, amount spent, destination and business purpose. If you use your own car, note miles driven instead of the amount spent. Note also any tolls paid or parking fees and keep receipts.

You’ll need to allocate your automobile expenses between business and personal use based on miles driven during the year. Proper recordkeeping is crucial in the event the IRS challenges you.

Your deduction can be computed using:

- A standard mileage rate (58.5¢ per business mile driven between Jan. 1 and June 30, 2022, and 62.5¢ per business mile driven between July 1 and Dec. 31, 2022) plus tolls and parking, or

- Actual expenses (including depreciation, subject to limitations) for the portion of car use allocable to the business. For this method, you’ll need to keep track of all costs for gas, repairs and maintenance, insurance, interest on a car loan and any other car-related costs.

Employees versus self-employed

From 2018 – 2025, employees, may not deduct unreimbursed local transportation costs. That’s because “miscellaneous itemized deductions” — a category that includes employee business expenses — are suspended (not allowed) for 2018 through 2025. However, self-employed taxpayers can deduct the expenses discussed in this article. But beginning with 2026, business expenses (including unreimbursed employee auto expenses) of employees are scheduled to be deductible again, as long as the employee’s total miscellaneous itemized deductions exceed 2% of adjusted gross income.

Contact us with any questions or to discuss the matter further.

© 2022

Mastercard has new rules for recurring transactions that entities must be aware of. Implementation of these rules has been delayed several times; currently, the rules are expected to take effect on March 21, 2023, for nonprofits. The rules essentially apply to any recurring transactions that are automatically charged to customers’ or donors’ Mastercard. Refer to Mastercard’s Transaction Processing Rules.

These are Mastercard’s terms and conditions. Therefore, if an entity accepts payment from Mastercard, it must follow these terms and conditions. For transactions from other credit card companies, such as Visa or Discover, the Mastercard terms and conditions do not apply. However, state laws may have similar requirements that an entity may be subject to. It also may be easier to structure the electronic systems to be the same regardless of the payment vendor.

These rules appear to be designed to assist the consumer and reduce chargebacks. Most consumers have some type of “subscription” that automatically “renews” or charges a credit card on a periodic, often monthly, basis. These rules are designed to make it easier for the consumer to cancel that subscription or renewal. Although the letter of the rules discusses ongoing and/or periodic delivery of physical products or digital goods, Mastercard’s FAQs indicate that recurring donations are also considered in this rule.

The rules start at the initiation of the transaction and so would apply to newly initiated transactions. When the entity obtains the Mastercard credentials for payment, they must disclose the price that will be billed and the billing frequency to their customer. The entity must clearly and prominently (i.e., no burying in the fine print) display the subscription terms on payment and order summary web pages. During the initiation, the entity must capture the cardholder’s affirmative acceptance of the subscription terms. It specifically states that a link to another website or expanding a message to scroll down does not satisfy this requirement. This may require a change in how website orders are confirmed. In addition, immediately after completing the subscription order, the entity must send their customer, through electronic communications, the subscription terms and clear instructions for how to cancel the subscription. Think of this as an email or a text message that the customer can keep.

In addition to initiation rules, there are rules for the subsequent transactions. These rules take effect on the date the changes in transaction processing rules take effect; that means if someone initiated a transaction in the year 2019 and is still doing that transaction, these rules will apply to the transactions processed starting on March 21, 2023. Each time a transaction (payment) occurs, the entity must provide the customer with a transaction receipt through electronic means, and it must include instructions for canceling the subscription. It also goes on to say the entity must provide an “online or electronic cancellation method (similar to unsubscribing from email messages or any other electronic method) or clear instructions for how to cancel that are easily accessible online (such as a “Manage Subscription” or a “Cancel Subscription” link on the merchant’s home page).” Some entities have inquired whether this requires the ability to unsubscribe online without having to call, or if the instructions can include calling a phone number to cancel; Mastercard has not clarified this.

There are also notification requirements for infrequent billings. For subscriptions where the billing is less frequent than every six months (180 days), the entity must send an electronic reminder about the billing at least 7 days, and no more than 30 days, before the next billing date. The reminder must include the subscription terms and how to cancel the subscription. It also cannot be part of marketing communications. Think of this as a reminder that amounts will be charged so the customer can stop the charges before they occur.

If your entity has recurring subscriptions/donations, ensure that you familiarize yourself with these rules in detail and the specific dates they take effect, which may be different for nonprofits. These rules apply to Mastercard transactions; other laws could also be applicable, and other credit card companies might have or add similar rules. Clearly, changes may need to be made to your electronic notices of payment. Most importantly, it needs to be easy for customers to see how to unsubscribe; this may involve changes to the website itself. Some payment portals have already made changes to comply with these rules, while others may require work on the entity’s part to do so.

When one business is sold to another, the buyer often asks for a determination letter to help assure that the seller’s 401(k) plan is qualified. The seller must then request such a letter from the IRS, but availability is restricted under certain rules. Assuming the 401(k) in question is an individually designed, single-employer plan, here’s some background on requesting a determination letter.

Evolving rules

The rules governing determination letter requests for individually designed plans have changed considerably over the years. At one time, requests could be made whenever a plan was restated or materially amended. Then, to limit submissions, the IRS adopted a cyclical remedial amendment system under which plans were typically submitted for a determination letter every five years.

In 2017, the IRS further narrowed the circumstances in which individually designed plans can request determination letters. The rules now allow individually designed 401(k) plans to be submitted for a determination letter only in one of the following circumstances:

- The plan hasn’t been submitted previously,

- The plan is being terminated,

- A limited determination is requested regarding whether a partial termination has occurred, or

- The plan has recently merged with the plan of a previously unrelated entity.

Keep in mind that additional rules may apply.

Limits to the letters

If a seller’s individually designed plan has received a favorable determination letter in the past, and it hasn’t recently merged with another plan, the seller could be unable to request the kind of determination letter the buyer wants. The seller might be able to request a determination as to whether a partial termination occurred, but that limited basis for seeking a determination letter wouldn’t allow the seller to provide the buyer with a determination regarding the current plan document.

In addition, determination letters affirm only that the form of the plan satisfies the applicable qualification requirements. Because the IRS reviews only the plan document, not plan administration, the determination letter wouldn’t offer a buyer any assurance regarding operation of the plan.

So, even if a seller is able to obtain a determination letter, it should anticipate having to demonstrate to the buyer that the plan’s operation satisfies the qualification rules and adheres to the plan document’s provisions. One example is by providing results of nondiscrimination testing.

Many details to consider

Special determination letter submission procedures apply for individually designed multiple employer plans. And different determination letter submission standards apply to plans that use a pre-approved plan document.

As you can see, there are many details to consider. We can answer questions and provide further information about the IRS rules for qualified retirement plans such as 401(k)s.

© 2022

Whether the economic climate is stable or volatile, one thing never changes: the need to protect your assets from risk. Hazards may occur as a result of factors entirely outside of your control, such as the stock market or the economy. It’s even possible that dangers lie closer to home, including the behavior of your heirs and creditors. In any case, it’s wise to consider taking steps to mitigate potential peril. One such step is to set up a trust.

Make sure it’s irrevocable

A trust can be a great way to protect your assets — but it must become the owner of the assets and be irrevocable. That is, you as the grantor can’t modify or terminate the trust after it has been set up. This is the opposite of a revocable trust, which allows the grantor to modify the trust.

Once you transfer assets into an irrevocable trust, you’ve effectively removed all of your rights of ownership to the assets and the trust. The benefit is that, because the property is no longer yours, it’s unavailable to satisfy claims against you.

Placing assets in a trust won’t allow you to sidestep responsibility for any debts or claims that are already outstanding at the time you fund the trust. There may also be a substantial “look-back” period that could negate the protection that would otherwise be provided.

Consider a spendthrift trust

If you’re concerned about what will happen to your assets after they pass to the next generation, you may want to consider a “spendthrift” trust. Despite the name, a spendthrift trust does more than just protect your heirs from themselves. It can protect your family’s assets against dishonest business partners or unscrupulous creditors.

The trust also protects loved ones in the event of relationship changes. For example, if your son divorces, his spouse generally won’t be able to claim a share of the trust property in the divorce settlement.

Several trust types can be designated as a spendthrift trust — you just need to add a spendthrift clause to the trust document. This type of clause restricts a beneficiary’s ability to assign or transfer his or her interests in the trust, and it restricts the rights of creditors to reach the trust assets. But a spendthrift trust won’t avoid claims from your own creditors unless you relinquish any interest in the trust assets.

Bear in mind that the protection offered by a spendthrift trust isn’t absolute. Depending on applicable law, it’s possible for government agencies to reach the trust assets to, for example, satisfy a delinquent tax debt.

You can gain greater protection against creditors’ claims if you give your trustee more discretion over trust distributions. If the trust requires the trustee to make distributions for a beneficiary’s support, for example, a court may rule that a creditor can reach the trust assets to satisfy support-related debts. For increased protection, give the trustee full discretion over whether and when to make distributions. You’ll need to balance the potentially competing objectives of having the access you want and preventing others from having access against your wishes.

Secure your assets

Obviously, you can choose from many types of trusts, depending on your particular circumstances. Talk to us to help you determine which type of trust is best for you going forward.

© 2022

When I was in college, I saw people struggling to get food. I had some free time and decided I wanted to spend it volunteering at the local food pantry to help those in need.

I started volunteering at Aid in Milan and, for the next few years, spent nearly every Friday packing food. It was a small, local food pantry when I first started there. Now, they have updated facilities and offer programs for different occasions like Christmas and back-to-school to help those in need.

I started volunteering at Aid in Milan and, for the next few years, spent nearly every Friday packing food. It was a small, local food pantry when I first started there. Now, they have updated facilities and offer programs for different occasions like Christmas and back-to-school to help those in need.

The staff and volunteers at Aid in Milan really care about the people who come through. They offer personalized options to fit everyone’s needs. If someone has a dietary restriction, certain foods can be substituted. If someone is having a tough time, the staff puts extra items in their food box. I am proud to support Aid in Milan. It is a great organization that provides a valuable service to those living in our small, rural community.

I give back because I want to support those who are struggling with hunger.