Dodge the Tumult with a Buy-sell Agreement

Businesses with multiple owners generally benefit from a variety of viewpoints, diverse experience and strategic areas of specialization. However, there’s a major risk: the company can be thrown into tumult if one of the owners decides, or is compelled by circumstances, to leave.

A logical and usually effective solution is to create and implement a buy-sell agreement. This is a legal document that spells out how an owner’s share in the business will be valued and transferred following a “triggering event” such as voluntary departure, divorce, disability or death.

Buy-sell benefits

A well-designed “buy-sell” (as it’s often called for short) manages risk in various ways. For starters, it helps keep ownership of the business within the family or another select group — for example, people actively involved in the enterprise rather than outsiders. In the case of a divorce, an agreement can prevent an owner’s soon-to-be former spouse from acquiring a business interest.

The death of an owner is a particularly difficult and often complex situation. A buy-sell can establish the value of the business for gift and estate tax purposes so long as certain requirements are met. The agreement is then able to play a role in providing the owner’s family with liquidity to pay estate taxes and other expenses.

Tax impact

Generally, buy-sell agreements are structured as either:

- Cross-purchase, under which the remaining owners buy the departing owner’s shares, or

- Redemption, under which the business entity itself buys the departing owner’s shares.

From a tax perspective, cross-purchase agreements are generally preferable. The remaining owners receive the equivalent of a “stepped-up basis” in the purchased shares. That is, their basis for those shares will be determined by the price paid, which is the current fair market value.

Having this higher basis will reduce their capital gains if they sell their interests down the road. Also, if the remaining owners fund the purchase with life insurance, the insurance proceeds are generally tax-free.

Redemption agreements, on the other hand, can trigger a variety of unwanted tax consequences. These include corporate alternative minimum tax, accumulated earnings tax or treatment of the purchase price as a taxable dividend.

However, there’s a disadvantage to cross-purchase agreements. That is, the owners, rather than the company, are personally responsible for funding the purchase of a departing owner’s interest. And if they use life insurance as a funding source, each owner will need to maintain policies on the life of each of the other shareholders — a potentially cumbersome and expensive arrangement.

Worth the effort

As you can see, the tax and legal details of a buy-sell agreement can get quite technical. But don’t let that discourage you from establishing one or occasionally reviewing a buy-sell you already have in place. We can help you in either case.

© 2022

The next quarterly estimated tax payment deadline is June 15 for individuals and businesses so it’s a good time to review the rules for computing corporate federal estimated payments. You want your business to pay the minimum amount of estimated taxes without triggering the penalty for underpayment of estimated tax.

Four methods

The required installment of estimated tax that a corporation must pay to avoid a penalty is the lowest amount determined under each of the following four methods:

- Under the current year method, a corporation can avoid the estimated tax underpayment penalty by paying 25% of the tax shown on the current tax year’s return (or, if no return is filed, 25% of the tax for the current year) by each of four installment due dates. The due dates are generally April 15, June 15, September 15 and January 15 of the following year.

- Under the preceding year method, a corporation can avoid the estimated tax underpayment penalty by paying 25% of the tax shown on the return for the preceding tax year by each of four installment due dates. (Note, however, that for 2022, certain corporations can only use the preceding year method to determine their first required installment payment. This restriction is placed on a corporation with taxable income of $1 million or more in any of the last three tax years.) In addition, this method isn’t available to corporations with a tax return that was for less than 12 months or a corporation that didn’t file a preceding tax year return that showed some tax liability.

- Under the annualized income method, a corporation can avoid the estimated tax underpayment penalty if it pays its “annualized tax” in quarterly installments. The annualized tax is computed on the basis of the corporation’s taxable income for the months in the tax year ending before the due date of the installment and assuming income will be received at the same rate over the full year.

- Under the seasonal income method, corporations with recurring seasonal patterns of taxable income can annualize income by assuming income earned in the current year is earned in the same pattern as in preceding years. There’s a somewhat complicated mathematical test that corporations must pass in order to establish that their income is earned seasonally and that they therefore qualify to use this method. If you think your corporation might qualify for this method, don’t hesitate to ask for our assistance in determining if it does.

Also, note that a corporation can switch among the four methods during a given tax year.

We can examine whether your corporation’s estimated tax bill can be reduced. Contact us if you’d like to discuss this matter further.

© 2022

The downturn in the stock market may have caused the value of your retirement account to decrease. But if you have a traditional IRA, this decline may provide a valuable opportunity: It may allow you to convert your traditional IRA to a Roth IRA at a lower tax cost.

Traditional vs. Roth

Here’s what makes a traditional IRA different from a Roth IRA:

Traditional IRA. Contributions to a traditional IRA may be deductible, depending on your modified adjusted gross income (MAGI) and whether you (or your spouse) participate in a qualified retirement plan, such as a 401(k). Funds in the account can grow tax deferred.

On the downside, you generally must pay income tax on withdrawals. In addition, you’ll face a penalty if you withdraw funds before age 59½ — unless you qualify for a handful of exceptions — and you’ll face an even larger penalty if you don’t take your required minimum distributions (RMDs) after age 72.

Roth IRA. Roth IRA contributions are never deductible. But withdrawals — including earnings — are tax free as long as you’re age 59½ or older and the account has been open at least five years. In addition, you’re allowed to withdraw contributions at any time tax- and penalty-free. You also don’t have to begin taking RMDs after you reach age 72.

However, the ability to contribute to a Roth IRA is subject to limits based on your MAGI. Fortunately, no matter how high your income, you’re eligible to convert a traditional IRA to a Roth. The catch? You’ll have to pay income tax on the amount converted.

Your tax hit may be reduced

This is where the “benefit” of a stock market downturn comes in. If your traditional IRA has lost value, converting to a Roth now rather than later will minimize your tax hit. Plus, you’ll avoid tax on future appreciation when the market goes back up.

It’s important to think through the details before you convert. Here are some of the issues to consider when deciding whether to make a conversion:

Having enough money to pay the tax bill. If you don’t have the cash on hand to cover the taxes owed on the conversion, you may have to dip into your retirement funds. This will erode your nest egg. The more money you convert and the higher your tax bracket, the bigger the tax hit.

Your retirement plans. Your stage of life may also affect your decision. Typically, you wouldn’t convert a traditional IRA to a Roth IRA if you expect to retire soon and start drawing down on the account right away. Usually, the goal is to allow the funds to grow and compound over time without any tax erosion.

Keep in mind that converting a traditional IRA to a Roth isn’t an all-or-nothing deal. You can convert as much or as little of the money from your traditional IRA account as you like. So, you might decide to gradually convert your account to spread out the tax hit over several years.

There are also other issues that need to be considered before executing a Roth IRA conversion. If this sounds like something you’re interested in, contact us to discuss whether a conversion is right for you.

© 2022

Disclosure of contingent liabilities — such as those associated with pending litigation or government investigations — is a gray area in financial reporting. It’s important to keep investors and lenders informed of risks that may affect a company’s future performance. But companies also want to avoid alarming stakeholders with losses that are unlikely to occur or disclosing their litigation strategies.

Understanding the GAAP requirements

Under Accounting Standards Codification (ASC) Topic 450, Contingencies, a company is required to classify contingent losses under the following categories:

Remote. If a contingent loss is remote, the chances that a loss will occur are slight. No disclosure or accrual is usually required for remote contingencies.

Probable. If a contingent loss is probable, it’s likely to occur and the company must record an accrual on the balance sheet and a loss on the income statement if the amount (or a range of amounts) can be reasonably estimated. Otherwise, the company should disclose the nature of the contingency and explain why the amount can’t be estimated. In general, there should be enough disclosure about a probable contingency so the disclosure’s reader can understand its magnitude.

Reasonably possible. If a contingent loss is reasonably possible, it falls somewhere between remote and probable. Here, the company must disclose it but doesn’t need to record an accrual. The disclosure should include an estimate of the amount (or the range of amounts) of the contingent loss or an explanation of why it can’t be estimated.

Making judgment calls

Determining the appropriate classification for a contingent loss requires judgment. It’s important to consider all scenarios and document your analysis of the classification.

In today’s volatile marketplace, conditions can unexpectedly change. You should re-evaluate contingencies each reporting period to determine whether your previous classification remains appropriate. For example, a remote contingent loss may become probable during the reporting period — or you might have additional information about a reasonably possible or probable contingent loss to be able to report an accrual (or update a previous estimate).

Outside expertise

Ultimately, management decides how to classify contingent liabilities. But external auditors will assess the company’s existing classifications and accruals to determine whether they seem appropriate. They’ll also look out for new contingencies that aren’t yet recorded. During fieldwork, your auditors may ask for supporting documentation and recommend adjustments to estimates and disclosures, if necessary, based on current market conditions. Contact us for more information.

© 2022

You can’t stop it; you can only hope to use it to your best business advantage. That’s right, summer is on the way and, with it, a variety of seasonal marketing opportunities for small to midsize companies. Here are three ideas to consider.

1. Support summer camps and local sports

Soon, millions of young people will be attending summer camps, both the “day” and “overnight” variety. Do some research into local options and see whether your business can arrange a sponsorship. If the cost is reasonable, you can get your name and logo on camp t-shirts and other items, where both campers and their parents will see them nearly every day for weeks.

Look into using the same strategy with summer sports. Baseball teams sponsored by local businesses are a time-honored tradition that can still pay off. There might be other, similar options as well.

2. Attend outdoor festivals or other public events

The warmer months mean parades, carnivals, outdoor musical performances and other spectacles of summertime bliss. Investigate the costs and logistics of setting up a booth with clear, attention-grabbing signage. Give out product samples or brochures to inform attendees about your company. You might also hand out small souvenirs, such as key chains, pens or magnets with your contact info.

And don’t just stay in the booth — dispatch employees into the crowd. Have staff members walk around outdoor events with samples or brochures. Just be sure to train them to be friendly and nonconfrontational. If appropriate, employees might wear distinctive clothing or even costumes or sandwich boards to draw attention.

3. Heat up your social media strategy

You probably knew this one was coming! For many, if not most, businesses today, using some form of social media to get the word out and interact with customers is a necessity. But hammering the same message 365 days a year isn’t likely to pay off. Tailor your social media strategy to celebrate summer and inspire interaction.

For example, launch a summertime travel photo contest. Come up with a catchy hashtag, preferably involving your company name, and invite followers to share pics from their summer vacation spots. Offer a nominal prize or enticing discount for the top three entries.

Alternatively, look around for some charitable events or activities that you, your leadership team and employees could participate in this summer. Post a narrative and pictures on your social media channels.

Make the most of midyear

As people head outside and on summer trips, raising awareness of your brand could mean a bump in sales and strong midyear revenues. We can help you assess the costs of potential marketing strategies and measure the return on investment of any you pursue.

© 2022

Many people own Series E and Series EE bonds that were bought many years ago. They may rarely look at them or think about them except on occasional trips to a file cabinet or safe deposit box.

One of the main reasons for buying U.S. savings bonds (such as Series EE bonds) is the fact that interest can build up without the need to currently report or pay tax on it. The accrued interest is added to the redemption value of the bond and is paid when the bond is eventually cashed in. Unfortunately, the law doesn’t allow for this tax-free buildup to continue indefinitely. The difference between the bond’s purchase price and its redemption value is taxable interest.

Series EE bonds, which have a maturity period of 30 years, were first offered in January 1980. They replaced the earlier Series E bonds.

Currently, Series EE bonds are only issued electronically. They’re issued at face value, and the face value plus accrued interest is payable at maturity.

Before January 1, 2012, Series EE bonds could be purchased on paper. Those paper bonds were issued at a discount, and their face value is payable at maturity. Owners of paper Series EE bonds can convert them to electronic bonds, posted at their purchase price (with accrued interest).

Here’s an example of how Series EE bonds are taxed. Bonds issued in January 1990 reached final maturity after 30 years, in January of 2020. That means that not only have they stopped earning interest, but all of the accrued and as yet untaxed interest was taxable in 2020.

A $1,000 Series EE bond (paper) bought in January 1990 for $500 was worth about $2,073.60 in January of 2020. It won’t increase in value after that. The entire difference of $1,573.60 ($2,073.60 − $500) was taxable as interest in 2020. This interest is exempt from state and local income taxes.

Note: Using the money from EE bonds for higher education may keep you from paying federal income tax on the interest.

If you own bonds (paper or electronic) that are reaching final maturity this year, action is needed to assure that there’s no loss of interest or unanticipated current tax consequences. Check the issue dates on your bonds. One possible place to reinvest the money is in Series I savings bonds, which are currently attractive due to rising inflation resulting in a higher interest rate.

© 2022

Are you a partner in a business? You may have come across a situation that’s puzzling. In a given year, you may be taxed on more partnership income than was distributed to you from the partnership in which you’re a partner.

Why does this happen? It’s due to the way partnerships and partners are taxed. Unlike C corporations, partnerships aren’t subject to income tax. Instead, each partner is taxed on the partnership’s earnings — whether or not they’re distributed. Similarly, if a partnership has a loss, the loss is passed through to the partners. (However, various rules may prevent a partner from currently using his or her share of a partnership’s loss to offset other income.)

Pass through your share

While a partnership isn’t subject to income tax, it’s treated as a separate entity for purposes of determining its income, gains, losses, deductions and credits. This makes it possible to pass through to partners their share of these items.

An information return must be filed by a partnership. On Schedule K of Form 1065, the partnership separately identifies income, deductions, credits and other items. This is so that each partner can properly treat items that are subject to limits or other rules that could affect their correct treatment at the partner’s level. Examples of such items include capital gains and losses, interest expense on investment debts and charitable contributions. Each partner gets a Schedule K-1 showing his or her share of partnership items.

Basis and distribution rules ensure that partners aren’t taxed twice. A partner’s initial basis in his or her partnership interest (the determination of which varies depending on how the interest was acquired) is increased by his or her share of partnership taxable income. When that income is paid out to partners in cash, they aren’t taxed on the cash if they have sufficient basis. Instead, partners just reduce their basis by the amount of the distribution. If a cash distribution exceeds a partner’s basis, then the excess is taxed to the partner as a gain, which often is a capital gain.

Illustrative example

Two people each contribute $10,000 to form a partnership. The partnership has $80,000 of taxable income in the first year, during which it makes no cash distributions to the two partners. Each of them reports $40,000 of taxable income from the partnership as shown on their K-1s. Each has a starting basis of $10,000, which is increased by $40,000 to $50,000. In the second year, the partnership breaks even (has zero taxable income) and distributes $40,000 to each of the two partners. The cash distributed to them is received tax-free. Each of them, however, must reduce the basis in his or her partnership interest from $50,000 to $10,000.

More rules and limits

The example and details above are an overview and, therefore, don’t cover all the rules. For example, many other events require basis adjustments and there are a host of special rules covering noncash distributions, distributions of securities, liquidating distributions and other matters. Contact us if you’d like to discuss how a partner is taxed.

© 2022

Back in late 2019, the first significant legislation addressing retirement savings since 2006 became law. The Setting Every Community Up for Retirement Enhancement (SECURE) Act has resulted in many changes to retirement and estate planning strategies, but it also raised some questions. The IRS has been left to fill the gaps, most recently with the February 2022 release of proposed regulations that have left many taxpayers confused and unsure of how to proceed.

The proposed regs cover numerous topics, but one of the most noteworthy is an unexpected interpretation of the so-called “10-year rule” for inherited IRAs and other defined contribution plans. If finalized, this interpretation — which contradicts earlier IRS guidance — could lead to larger tax bills for certain beneficiaries.

Birth of the 10-year rule

Before the SECURE Act was enacted, beneficiaries of inherited IRAs could “stretch” the required minimum distributions (RMDs) on such accounts over their entire life expectancies. The stretch period could be decades for younger heirs, meaning they could take smaller distributions and defer taxes while the accounts grew.

In an effort to accelerate tax collection, the SECURE Act eliminated the rules that allowed stretch IRAs for many heirs. For IRA owners or defined contribution plan participants who die in 2020 or later, the law generally requires that the entire balance of the account be distributed within 10 years of death. This rule applies regardless of whether the deceased died before, on or after the required beginning date (RBD) for RMDs. Under the SECURE Act, the RBD is age 72.

The SECURE Act recognizes exceptions for the following types of “eligible designated beneficiaries” (EDBs):

- Surviving spouses,

- Children younger than “the age of majority,”

- Individuals with disabilities,

- Chronically ill individuals, and

- Individuals who are no more than 10 years younger than the account owner.

EDBs may continue to stretch payments over their life expectancies (or, if the deceased died before the RBD, they may elect the 10-year rule treatment). The 10-year rule will apply to the remaining amounts when an EDB dies.

The 10-year rule also applies to trusts, including see-through or conduit trusts that use the age of the oldest beneficiary to stretch RMDs and prevent young or spendthrift beneficiaries from rapidly draining inherited accounts.

Prior to the release of the proposed regs, the expectation was that non-EDBs could wait until the end of the 10-year period and take the entire account as a lump-sum distribution, rather than taking annual taxable RMDs. This distribution approach generally would be preferable, especially if an heir is working during the 10 years and in a higher tax bracket. Such heirs could end up on the hook for greater taxes than anticipated if they must take annual RMDs.

The IRS has now muddied the waters with conflicting guidance. In March 2021, it published an updated Publication 590-B, “Distributions from Individual Retirement Arrangements (IRAs),” which suggested that annual RMDs would indeed be required for years one through nine post-death. But, just a few months later, it again revised the publication to specify that “the beneficiary is allowed, but not required, to take distributions prior to” the 10-year deadline.

That position didn’t last long. The proposed regs issued in February call for annual RMDs in certain circumstances.

Proposed regs regarding the 10-year rule

According to the proposed regs, as of January 1, 2022, non-EDBs who inherit an IRA or defined contribution plan before the deceased’s RBD satisfy the 10-year rule simply by taking the entire sum before the end of the calendar year that includes the 10th anniversary of the death. The regs take a different tack when the deceased passed on or after the RBD.

In that case, non-EDBs must take annual RMDs (based on their life expectancies) in year one through nine, receiving the remaining balance in year 10. The annual RMD rule gives beneficiaries less flexibility and could push them into higher tax brackets during those years. (Note that Roth IRAs don’t have RMDs, so beneficiaries need only empty the accounts by the end of 10 years.)

Aside from those tax implications, this stance creates a conundrum for non-EDBs who inherited an IRA or defined contribution plan in 2020. Under the proposed regs, they should have taken an annual RMD for 2021, seemingly subjecting them to a penalty for failure to do so, equal to 50% of the RMD they were required to take. But the proposed regs didn’t come out until February of 2022.

What about non-EDBs who are minors when they inherit the account but reach the “age of majority” during the 10-year post-death period? Those beneficiaries can use the stretch rule while minors, but the annual RMD will apply after the age of majority (assuming the deceased died on or after the RBD).

If the IRS’s most recent interpretation of the 10-year rule sticks, non-EDBs will need to engage in tax planning much sooner than they otherwise would. For example, it could be wise to take more than the annual RMD amount to more evenly spread out the tax burden over the 10 years. They also might want to adjust annual distribution amounts based on factors such as other income or deductions for a particular tax year.

Clarifications of the exceptions

The proposed regs clarify some of the terms relevant to determining whether an heir is an EDB. For example, they define the “age of majority” as age 21 — regardless of how the term is defined under the applicable state law.

The definition of “disability” turns on the beneficiary’s age. If under age 18 at the time of the deceased’s death, the beneficiary must have a medically determinable physical or mental impairment that 1) results in marked and severe functional limitations, and 2) can be expected to result in death or be of long-continued and indefinite duration. Beneficiaries age 18 or older are evaluated under a provision of the tax code that considers whether the individual is “unable to engage in substantial gainful activity.”

Wait and see?

The U.S. Treasury Department is accepting comments on the proposed regs through May 25, 2022, and will hold a public hearing on June 15, 2022. Non-EDBs who missed 2021 RMDs may want to delay action to see if more definitive guidance comes out before year-end, including, ideally, relief for those who relied on the version of Publication 590-B that indicated RMDs weren’t necessary. As always, though, contact us to determine the best course for you in light of new developments.

© 2022

What Governments Need to Know Now for GASB 87 – Leases

URGENT! Your budget may NEED TO BE AMENDED to coincide with the implementation of GASB 87.

Background

Ready or not…GASB Statement No. 87 – Leases is here! This GASB must be implemented in the June 30, 2022 financial statements. GASB 87 requires a lessee to recognize a lease liability and an intangible right-to-use lease asset, and a lessor is required to recognize a lease receivable and a deferred inflow of resources.

Practical hint: Short-term (less than one year) leases will be recorded as operating leases had been.

What to do now

Get lease information ready, amend the fiscal year 2021-22 budget for any new current year leases (exceeding one year), and make journal entries for leases before closing out the current fiscal year.

Information to collect

For current leases:

- Lease description

- Original lease term

- Any renewal options, and the determination of the likelihood of utilizing those options

- Components of the payments (fixed, variable, interest rate)

- Who has the right to terminate the lease

- Lease obligation maturities for the next five years and beyond (similar to debt maturity schedule)

Leases initiated after 7/1/21 (in this fiscal year):

- Calculate the right-of-use asset and lease liability. Practical hint: Total cost of leased equipment (as if a “capital lease”).

- Governmental Fund Level: In the current fiscal year ending June 30, 2022 – this will be included as a:

- Revenue: Other financing sources – lease financing

- Expenditure: Lease right-to-use assets (capital outlay)

- URGENT: Include Revenue and Expenditure amounts in final budget amendments for the current fiscal year for the Governmental Funds (ending June 30, 2022).

- Business-type funds, Internal Service Funds, and Government-wide level: In the current fiscal year ending June 30, 2022 – this will be included as:

- Asset: Right-to-use assets

- Liability: Lease liability

Your Yeo & Yeo professionals will provide additional guidance and individual assistance during the audit process.

Background

It is here – GASB Statement No. 87, Leases. This GASB must be implemented in school districts’ June 30, 2022, financial statements. The objective of the new GASB is to improve accounting and financial reporting for leases. Another objective is to increase financial statements’ usefulness by recognizing certain lease assets and liabilities for leases that were previously classified as operating leases and recognized as inflows or outflows of resources based on the contract’s payment provisions. GASB 87 requires a lessee to recognize a lease liability and an intangible right-to-use lease asset. A lessor must recognize a lease receivable and a deferred inflow of resources.

What to do now

Get lease information ready, amend the fiscal year 2021-22 budget for any new current year leases (exceeding one year), and make journal entries for leases before closing out the current fiscal year.

Information to collect

For current leases:

- Lease description

- Original lease term

- Any renewal options, and the determination of the likelihood of utilizing those options

- Components of the payments (fixed, variable, interest rate)

- Who has the right to terminate the lease

- Lease obligation maturities for the next five years and beyond (similar to debt maturity schedule)

Practical hint: Short-term (less than one year) leases will be recorded as operating leases had been. Leases over one year will be recorded on district-wide financials, and in the year of inception, the lease will be recorded on the fund level statements.

How to Calculate

Leases (where the district is the lessee) existing prior to 7/1/21 (before this fiscal year)

- Calculate lease liability as of 7/1/21. This will be the right-of-use asset and liability for district-wide beginning balances.

- This will not change fund level statements.

Leases existing after 7/1/21 (in this fiscal year)

- Calculate the right-of-use asset/lease liability. Practical hint: Total cost of leased equipment (as if a “capital lease”).

- Fund level: In the current fiscal year ending June 30, 2022 – this will be included as a:

- Revenue: Other financing sources – lease financing

- Expenditure: Lease right-to-use assets (capital outlay)

- URGENT: Include Revenue and Expenditure amounts in final budget amendments for the current fiscal year (ending June 30, 2022).

- District-wide level: In the current fiscal year ending June 30, 2022 – this will be included as:

- Asset: Right-to-use assets

- Liability: Lease liability

Leases (where the district is the lessor)

- Calculate lease receivable as of 6/30/2022. This will be recorded as an Account Receivable and Deferred inflow.

- This will change fund level statements. It will be on both the district-wide and governmental fund statements.

For the fiscal year 2022-23 and beyond, maintain the above list of information on leases. Work with your auditor, if necessary, to determine which leases require the underlying asset to be recorded as a right-to-use asset and include such leases in budgets going forward.

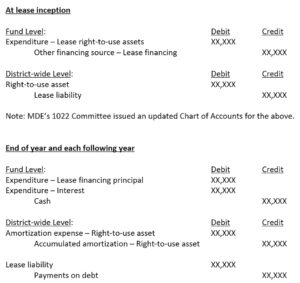

Journal Entries

Are you a charitably minded individual who is also taking distributions from a traditional IRA? You may want to consider the tax advantages of making a cash donation to an IRS-approved charity out of your IRA.

When distributions are taken directly out of traditional IRAs, federal income tax of up to 37% in 2022 will have to be paid. State income taxes may also be owed.

Qualified charitable distributions

One popular way to transfer IRA assets to charity is via a tax provision that allows IRA owners who are age 70½ or older to direct up to $100,000 per year of their IRA distributions to charity. These distributions are known as qualified charitable distributions (QCDs). The money given to charity counts toward your required minimum distributions (RMDs) but doesn’t increase your adjusted gross income (AGI) or generate a tax bill.

Keeping the donation out of your AGI may be important for several reasons. Here are some of them:

- It can help you qualify for other tax breaks. For example, having a lower AGI can reduce the threshold for deducting medical expenses, which are only deductible to the extent they exceed 7.5% of AGI.

- You can avoid rules that can cause some or all of your Social Security benefits to be taxed and some or all of your investment income to be hit with the 3.8% net investment income tax.

- It can help you avoid a high-income surcharge for Medicare Part B and Part D premiums, which kick in if AGI is over certain levels.

- The distributions going to the charity won’t be subject to federal estate tax and generally won’t be subject to state death taxes.

Important points: You can’t claim a charitable contribution deduction for a QCD not included in your income. Also keep in mind that the age after which you must begin taking RMDs is 72, but the age you can begin making QCDs is 70½.

To benefit from a QCD for 2022, you must arrange for a distribution to be paid directly from the IRA to a qualified charity by December 31, 2022. You can use QCDs to satisfy all or part of the amount of your RMDs from your IRA. For example, if your 2022 RMDs are $10,000, and you make a $5,000 QCD for 2022, you have to withdraw another $5,000 to satisfy your 2022 RMDs.

Other rules and limits may apply. Want more information? Contact us to see whether this strategy would be beneficial in your situation.

© 2022

Businesses should be aware that they may be responsible for issuing more information reporting forms for 2022 because more workers may fall into the required range of income to be reported. Beginning this year, the threshold has dropped significantly for the filing of Form 1099-K, “Payment Card and Third-Party Network Transactions.” Businesses and workers in certain industries may receive more of these forms and some people may even get them based on personal transactions.

Background of the change

Banks and online payment networks — payment settlement entities (PSEs) or third-party settlement organizations (TPSOs) — must report payments in a trade or business to the IRS and recipients. This is done on Form 1099-K. These entities include Venmo and CashApp, as well as gig economy facilitators such as Uber and TaskRabbit.

A 2021 law dropped the minimum threshold for PSEs to file Form 1099-K for a taxpayer from $20,000 of reportable payments made to the taxpayer and 200 transactions to $600 (the same threshold applicable to other Forms 1099) starting in 2022. The lower threshold for filing 1099-K forms means many participants in the gig economy will be getting the forms for the first time.

Members of Congress have introduced bills to raise the threshold back to $20,000 and 200 transactions, but there’s no guarantee that they’ll pass. In addition, taxpayers should generally be reporting income from their side employment engagements, whether it’s reported to the IRS or not. For example, freelancers who make money creating products for an Etsy business or driving for Uber should have been paying taxes all along. However, Congress and the IRS have said this responsibility is often ignored. In some cases, taxpayers may not even be aware that income from these sources is taxable.

Some taxpayers may first notice this change when they receive their Forms 1099-K in January 2023. However, businesses should be preparing during 2022 to minimize the tax consequences of the gross amount of Form 1099-K reportable payments.

What to do now

Taxpayers should be reviewing gig and other reportable activities. Make sure payments are being recorded accurately. Payments received in a trade or business should be reported in full so that workers can withhold and pay taxes accordingly.

If you receive income from certain activities, you may want to increase your tax withholding or, if necessary, make estimated tax payments or larger payments to avoid penalties.

Separate personal payments and track deductions

Taxpayers should separate taxable gross receipts received through a PSE that are income from personal expenses, such as splitting the check at a restaurant or giving a gift. PSEs can’t necessarily distinguish between personal expenses and business payments, so taxpayers should maintain separate accounts for each type of payment.

Keep in mind that taxpayers who haven’t been reporting all income from gig work may not have been documenting all deductions. They should start doing so now to minimize the taxable income recognized due to the gross receipts reported on Form 1099-K. The IRS is likely to take the position that all of a taxpayer’s gross receipts reported on Form 1099-K are income and won’t allow deductions unless the taxpayer substantiates them. Deductions will vary based on the nature of the taxpayer’s work.

Contact us if you have questions about your Form 1099-K responsibilities.

© 2022

When creating forward-looking financials, you generally have two options under AICPA Attestation Standards Section 301, Financial Forecasts and Projections:

1. Forecast. Prospective financial statements that present, to the best of the responsible party’s knowledge and belief, an entity’s expected financial position, results of operations and cash flows. A financial forecast is based on the responsible party’s assumptions reflecting the conditions it expects to exist and the course of action it expects to take.

2. Projection. Prospective financial statements that present, to the best of the responsible party’s knowledge and belief, given one or more hypothetical assumptions, an entity’s expected financial position, results of operations and cash flows. A financial projection is sometimes prepared to present one or more hypothetical courses of action for evaluation, as in response to a question such as, “What would happen if … ?”

Subtle difference

The terms “forecast” and “projection” are sometimes used interchangeably. But there’s a noteworthy distinction, a forecast represents expected results based on the expected course of action. These are the most common type of prospective reports for companies with steady historical performance that plan to maintain the status quo.

On the flip side, a projection estimates the company’s expected results based on various hypothetical situations that may or may not occur. These statements are typically used when management is uncertain whether performance targets will be met. So, they may be appropriate for start-ups or when evaluating results over a longer period because there’s a good chance that customer demand or market conditions could change over time.

Critical components

Regardless of whether you opt for a forecast or projection, the report will generally be organized using the same format as your financial statements with an income statement, balance sheet and cash flow statement. Most prospective statements conclude with a statement of key assumptions that underlie the numbers. Many assumptions are driven by your company’s historical financial statements, along with a detailed sales budget for the year.

Instead of relying on static forecasts or projections — which can quickly become outdated in a volatile marketplace — some companies now use rolling 12-month versions that are adaptable and look beyond year end. This helps you identify and respond to weaknesses in your assumptions, as well as unexpected changes in the marketplace. For example, a manufacturer that experiences a shortage of raw materials could experience an unexpected drop in sales until conditions improve. If the company maintains a rolling forecast, it would be able to revise its plans for such a temporary disruption.

Contact us

Planning for the future is an important part of running a successful business. While no forecast or projection will be 100% accurate in these uncertain times, we can help you evaluate the alternatives for issuing prospective financial statements and offer fresh, objective insights about what may lie ahead for your business.

© 2022

Taking care of an elderly parent or grandparent may provide more than just personal satisfaction. You could also be eligible for tax breaks. Here’s a rundown of some of them.

1. Medical expenses. If the individual qualifies as your “medical dependent,” and you itemize deductions on your tax return, you can include any medical expenses you incur for the individual along with your own when determining your medical deduction. The test for determining whether an individual qualifies as your “medical dependent” is less stringent than that used to determine whether an individual is your “dependent,” which is discussed below. In general, an individual qualifies as a medical dependent if you provide over 50% of his or her support, including medical costs.

However, bear in mind that medical expenses are deductible only to the extent they exceed 7.5% of your adjusted gross income (AGI).

The costs of qualified long-term care services required by a chronically ill individual and eligible long-term care insurance premiums are included in the definition of deductible medical expenses. There’s an annual cap on the amount of premiums that can be deducted. The cap is based on age, going as high as $5,640 for 2022 for an individual over 70.

2. Filing status. If you aren’t married, you may qualify for “head of household” status by virtue of the individual you’re caring for. You can claim this status if:

- The person you’re caring for lives in your household,

- You cover more than half the household costs,

- The person qualifies as your “dependent,” and

- The person is a relative.

If the person you’re caring for is your parent, the person doesn’t need to live with you, so long as you provide more than half of the person’s household costs and the person qualifies as your dependent. A head of household has a higher standard deduction and lower tax rates than a single filer.

3. Tests for determining whether your loved one is a “dependent.” Dependency exemptions are suspended (or disallowed) for 2018–2025. Even though the dependency exemption is currently suspended, the dependencytests still apply when it comes to determining whether a taxpayer is entitled to various other tax benefits, such as head-of-household filing status.

For an individual to qualify as your “dependent,” the following must be true for the tax year at issue:

- You must provide more than 50% of the individual’s support costs,

- The individual must either live with you or be related,

- The individual must not have gross income in excess of an inflation-adjusted exemption amount,

- The individual can’t file a joint return for the year, and

- The individual must be a U.S. citizen or a resident of the U.S., Canada or Mexico.

4. Dependent care credit. If the cared-for individual qualifies as your dependent, lives with you, and physically or mentally can’t take care of him- or herself, you may qualify for the dependent care credit for costs you incur for the individual’s care to enable you and your spouse to go to work.

Contact us if you’d like to further discuss the tax aspects of financially supporting and caring for an elderly relative.

© 2022

At Yeo & Yeo CPAs & Business Consultants, we take pride in creating an environment that challenges, supports and rewards our employees. We are family-focused, community-driven and relationship-oriented. And we love to see our employees grow and succeed.

We are honored to have been named one of West Michigan’s Best and Brightest Companies to Work For for the eighteenth consecutive year. The Best and Brightest programs identify, recognize and celebrate organizations that exemplify Better Business. Richer Lives. Stronger Communities.

Yeo & Yeo is proud of the environment we have created for our employees. We offer an award-winning CPA certification bonus program, gold standard benefits, and hybrid and remote work capabilities. Our West Michigan staff shared five reasons why our firm is such a great place to work:

- Empowerment: “In my second year as a partner, I was allowed to lead the firm’s Tax Service Line. I am grateful for the trust the firm’s leadership placed in me, especially as a younger professional at the time. As a firm, we empower our employees to lead and give them opportunities for growth and development throughout their careers.” – David Jewell, CPA, Managing Principal

- Flexibility: “One of the things I appreciate about Yeo & Yeo is that the company recognizes that each employee is different, and is willing to be flexible to accommodate each employee’s needs. We don’t have a set work schedule that everyone has to adhere to, and we are encouraged to find a path within the company that works for us and what we want to accomplish.” – Megan Taylor, CPA, Manager

- Family-focused: “I appreciate that we’re given the respect and autonomy to have flexible work schedules. We’re trusted to complete the work and given opportunities to enjoy a rewarding career without compromising on personal, family time.” – Chelsea Meyer, CPA, Manager

- Relationships: “We are not a big four firm. Everyone is not just a number. We really help each other on an individual level. We feel like we are a family. It doesn’t matter where you sit. We all work together.” – Michael Oliphant, CPA, CVA, Principal

- People first: “Yeo & Yeo treats you well. As a first-year principal, I can wholeheartedly say that the decisions the partner group makes are always in the best interest of the employees. They listen and respond. They work hard every day to create an inclusive and supportive environment. I am lucky to be around such a great group of professionals.” – Michael Evrard, CPA, Principal

What will your story be? Apply today to write the next chapter in your career.

The IRS recently released guidance providing the 2023 inflation-adjusted amounts for Health Savings Accounts (HSAs). High inflation rates will result in next year’s amounts being increased more than they have been in recent years.

HSA basics

An HSA is a trust created or organized exclusively for the purpose of paying the “qualified medical expenses” of an “account beneficiary.” An HSA can only be established for the benefit of an “eligible individual” who is covered under a “high deductible health plan.” In addition, a participant can’t be enrolled in Medicare or have other health coverage (exceptions include dental, vision, long-term care, accident and specific disease insurance).

A high deductible health plan (HDHP) is generally a plan with an annual deductible that isn’t less than $1,000 for self-only coverage and $2,000 for family coverage. In addition, the sum of the annual deductible and other annual out-of-pocket expenses required to be paid under the plan for covered benefits (but not for premiums) can’t exceed $5,000 for self-only coverage, and $10,000 for family coverage.

Within specified dollar limits, an above-the-line tax deduction is allowed for an individual’s contribution to an HSA. This annual contribution limitation and the annual deductible and out-of-pocket expenses under the tax code are adjusted annually for inflation.

Inflation adjustments for next year

In Revenue Procedure 2022-24, the IRS released the 2023 inflation-adjusted figures for contributions to HSAs, which are as follows:

Annual contribution limitation. For calendar year 2023, the annual contribution limitation for an individual with self-only coverage under an HDHP will be $3,850. For an individual with family coverage, the amount will be $7,750. This is up from $3,650 and $7,300, respectively, for 2022.

In addition, for both 2022 and 2023, there’s a $1,000 catch-up contribution amount for those who are age 55 and older at the end of the tax year.

High deductible health plan defined. For calendar year 2023, an HDHP will be a health plan with an annual deductible that isn’t less than $1,500 for self-only coverage or $3,000 for family coverage (these amounts are $1,400 and $2,800 for 2022). In addition, annual out-of-pocket expenses (deductibles, co-payments, and other amounts, but not premiums) won’t be able to exceed $7,500 for self-only coverage or $15,000 for family coverage (up from $7,050 and $14,100, respectively, for 2022).

Reap the rewards

There are a variety of benefits to HSAs. Contributions to the accounts are made on a pre-tax basis. The money can accumulate tax free year after year and can be withdrawn tax free to pay for a variety of medical expenses such as doctor visits, prescriptions, chiropractic care and premiums for long-term care insurance. In addition, an HSA is “portable.” It stays with an account holder if he or she changes employers or leaves the workforce. If you have questions about HSAs at your business, contact your employee benefits and tax advisors.

© 2022

Maintaining the status quo in today’s volatile marketplace can be risky. To succeed, businesses need to “level up” by being proactive and adaptable. But some managers may be unsure where to start or they’re simply out of new ideas.

Fortunately, when audited financial statements are delivered, they’re accompanied by a management letter that suggests ways to maximize your company’s efficiency and minimize its risk. These letters may contain fresh, external perspectives and creative solutions to manage supply chain shortages, inflationary pressures and other current developments.

Auditing standards

Under Generally Accepted Auditing Standards, auditors must communicate in writing about material weaknesses or significant deficiencies in internal controls that are discovered during audit fieldwork. A material weakness is defined as “a deficiency, or combination of deficiencies, in internal control, such that there is a reasonable possibility that a material misstatement of the entity’s financial statements will not be prevented, or detected and corrected on a timely basis.”

Significant deficiencies are generally considered less severe than material weaknesses. A significant deficiency is “a deficiency, or a combination of deficiencies, in internal control that is … important enough to merit attention by those charged with governance.”

Auditors may unearth less severe weaknesses and operating inefficiencies during the course of an audit. Although reporting these items is optional, they’re often included in the management letter. The write-up for each deficiency includes an observation (including a cause, if observed), financial and qualitative impacts, and a recommended course of action.

From compliance to business improvement

Audits should be more than just an exercise in compliance. Management letters summarize lessons learned during audit fieldwork on how to improve various aspects of the company’s operations.

For example, a management letter might report a significant increase in the average accounts receivable collection period from the prior year. Then the letter might provide cost-effective suggestions on how to expedite collections, such as implementing early-bird discounts and using electronic payment systems to enable real-time invoices and online payment. Finally, the letter might explain how improved collections would potentially boost operating cash flow and decrease write-offs for bad debts.

When you review the management letter, remember that your auditor isn’t grading your performance. The letter is designed to provide advice based on best practices that the audit team has learned over the years from working with other clients.

Observant auditors may comment on a wide range of issues they encounter during the course of an audit. Examples — beyond internal controls — include cash management, operating workflow, control of production schedules, capacity issues, defects and waste, employee benefits, safety, website management, technology improvements and energy consumption.

Take your audit to the next level

Always take the time to review the management letter that’s delivered with your audited financial statements — don’t just file it away for a later date. Too often, the same talking points are repeated year after year. Proactive managers recognize the valuable insights these letters contain, and they contact us to discuss how to implement changes as soon as possible.

© 2022

The April tax filing deadline has passed, but that doesn’t mean you should push your taxes out of your mind until next year. Here are three tax-related actions that you should consider taking in the near term (if you filed on time and didn’t file for an extension).

Retain the requisite records

Depending on the specific issue, the IRS has years to audit your tax return so it’s critical to maintain the records you may need to defend yourself. You generally need to keep the documents that support your income, deductions and credits for at least three years after the tax-filing deadline. (Note that no time limit applies to how long the IRS has to pursue taxpayers who don’t file or file fraudulent returns.)

Essential documentation to retain may include:

- Form W-2, “Wage and Tax Statement,”

- Form 1099-NEC, “Nonemployee Compensation,” 1099-MISC, “Miscellaneous Income,” and 1099-G, “Certain Government Payments,”

- Form 1098, “Mortgage Interest Statement,”

- Property tax payments,

- Charitable donation receipts,

- Records related to contributions to and withdrawals from Section 529 plans and Health Savings Accounts, and

- Records related to deductible retirement plan contributions.

Hold on to records relating to property (including improvements to property) until the period of limitations expires for the year in which you dispose of the property. You’ll need those records to calculate your gain or loss.

Plan for your 2022 taxes

You should be collecting the documentation you’ll need for next year’s tax filing deadline on an ongoing basis. Keep up-to-date records of items such as charitable donations and mileage expenses.

In addition, this is a good time to reassess your current tax withholding to determine if you need to update your Form W-4, “Employee’s Withholding Certificate.” You may want to increase withholding if you owed taxes this year. Conversely, you might want to reduce it if you received a hefty refund. Changes also might be in order if you expect to experience certain major life changes, such as marriage, divorce, childbirth or adoption this year.

If you make estimated tax payments throughout the year, consider reevaluating the amounts you pay. You might want to increase or reduce the payments on account of changes in self-employment income, investment income, Social Security benefits and other types of nonwage income. To preempt the risk of a penalty for underpayment of estimated tax, consider paying at least 90% of the tax for the current year or 100% of the tax shown on your prior year’s tax return, whichever amount is less.

When it comes to strategies to reduce your 2022 tax bill, recent downturns in the stock market may have some upside. If you have substantial funds in a traditional IRA, this could be a ripe time to convert them to a Roth IRA. Roth IRAs have no required mandatory distributions, and distributions are tax-free. You must pay income tax on the fair market value of the converted assets, but, if you convert securities that have fallen in value or you’re in a lower tax bracket in 2022, you could pay less in taxes now than you would in the future. Moreover, any subsequent appreciation will be tax-free.

The market downturn could provide loss-harvesting opportunities, too. By selling poorly performing investments before year end, you can offset realized taxable gains on a dollar-for-dollar basis. If you end up with excess losses, you generally can apply up to $3,000 against your ordinary income and carry forward the balance to future tax years.

If you itemize deductions on your tax return, you also might consider “bunching” expected medical expenses into 2022 to increase the odds that you can claim the medical and dental expense deduction. You’re allowed to deduct unreimbursed expenses that exceed 7.5% of your adjusted gross income. If you expect to have, for example, a knee replacement surgery next winter, accelerating it (and all of the follow-up appointments and physical therapy) into this year could put you over the 7.5% threshold.

Respond to an IRS question or audit

You might have no choice but to continue thinking about your taxes if you receive a tax return question or audit letter from the IRS (and you would be notified only by a letter — the IRS doesn’t initiate inquiries or audits by telephone, text or email). Such letters can be alarming, but don’t assume the worst.

It’s important to remember that receiving a question or being selected for an audit doesn’t always mean you’ve tripped up somehow. For example, your tax return could have been flagged based on a statistical formula that compares similar returns for deviations from “norms.”

Further, if selected, you’re most likely going to undergo a correspondence audit; these audits account for more than 70% of IRS audits. They’re conducted by mail for a single tax year and involve only a few issues that the IRS anticipates it can resolve by reviewing relevant documents. According to the IRS, most audits involve returns filed within the last two years.

If you receive notification of a correspondence audit, you and your tax advisor should closely follow the instructions. You can request additional time if you can’t submit all documentation requested by the specified deadline. It’s advisable to submit copies instead of original documents, and each page of documentation should be marked with your name, Social Security number and the tax year under scrutiny.

Don’t ignore the letter. Doing so will eventually lead to the IRS disallowing the item(s) claimed and issuing a Notice of Deficiency (that is, a notice that a balance is due). You’ll then have 90 days to petition the U.S. Tax Court for review.

While correspondence audits are by far the most common, you could be selected for an office audit (in an IRS office) or field audit (at the taxpayer’s place of business). These are more intensive, and you should consult a tax professional with expertise in handling these types of exams.

Stay ahead of the game

Tax planning is an ongoing challenge. We can help you take the necessary steps to minimize your filing burden, your tax liability and the risk of bad results if you’re ever flagged for an audit.

© 2022

If you donate valuable items to charity, you may be required to get an appraisal. The IRS requires donors and charitable organizations to supply certain information to prove their right to deduct charitable contributions. If you donate an item of property (or a group of similar items) worth more than $5,000, certain appraisal requirements apply. You must:

- Get a “qualified appraisal,”

- Receive the qualified appraisal before your tax return is due,

- Attach an “appraisal summary” to the first tax return on which the deduction is claimed,

- Include other information with the return, and

- Maintain certain records.

Keep these definitions in mind. A qualified appraisal is a complex and detailed document. It must be prepared and signed by a qualified appraiser. An appraisal summary is a summary of a qualified appraisal made on Form 8283 and attached to the donor’s return.

While courts have allowed taxpayers some latitude in meeting the “qualified appraisal” rules, you should aim for exact compliance.

The qualified appraisal isn’t submitted separately to the IRS in most cases. Instead, the appraisal summary, which is a separate statement prepared on an IRS form, is attached to the donor’s tax return. However, a copy of the appraisal must be attached for gifts of art valued at $20,000 or more and for all gifts of property valued at more than $500,000, other than inventory, publicly traded stock and intellectual property. If an item has been appraised at $50,000 or more, you can ask the IRS to issue a “Statement of Value” that can be used to substantiate the value.

Failure to comply with the requirements

The penalty for failing to get a qualified appraisal and attach an appraisal summary to the return is denial of the charitable deduction. The deduction may be lost even if the property was valued correctly. There may be relief if the failure was due to reasonable cause.

Exceptions to the requirement

A qualified appraisal isn’t required for contributions of:

- A car, boat or airplane for which the deduction is limited to the charity’s gross sales proceeds,

- stock in trade, inventory or property held primarily for sale to customers in the ordinary course of business,

- publicly traded securities for which market quotations are “readily available,” and

- qualified intellectual property, such as a patent.

Also, only a partially completed appraisal summary must be attached to the tax return for contributions of:

- Nonpublicly traded stock for which the claimed deduction is greater than $5,000 and doesn’t exceed $10,000, and

- Publicly traded securities for which market quotations aren’t “readily available.”

More than one gift

If you make gifts of two or more items during a tax year, even to multiple charitable organizations, the claimed values of all property of the same category or type (such as stamps, paintings, books, stock that isn’t publicly traded, land, jewelry, furniture or toys) are added together in determining whether the $5,000 or $10,000 limits are exceeded.

The bottom line is you must be careful to comply with the appraisal requirements or risk disallowance of your charitable deduction. Contact us if you have any further questions or want to discuss your contribution planning.

© 2022

The coronavirus pandemic has brought about several new funding streams that your organization may have received. If so, you will likely need to give more consideration to audit and compliance requirements than you have given attention to in previous years. Your organization may even be subject to a single audit for the first time, which could be a daunting process to go through if you are unprepared. Following are some special considerations to think about.

- Will you need a single audit? If you expended more than $750,000 of federal funds, you’ll likely need one (however, more on this below). In basic terms, this a more intensive audit that requires additional reporting outside of your basic financial statement audit. The single audit will communicate:

- an opinion as to whether you have complied with all material compliance requirements of your major federal programs,

- any noncompliance that was noted specific to other laws, regulations, and grant agreements,

- any internal control deficiencies over compliance or financial reporting that were noted during the audit, and

- an opinion as to the accuracy of the schedule of federal awards’ expenditures in relation to your financial statements as a whole.

Your auditor will need to perform a great deal of additional testing to complete this reporting and increased effort to prepare will be required on your part. You should make a single audit determination and let your auditor know as soon as possible, so both parties will have enough notice to plan and prepare for the single audit.

- If a single audit is needed, a new statement called the schedule of expenditures of federal awards (SEFA) will be required. Your auditor will need an accurate schedule well in advance of the audit to communicate which grants will be selected as major programs, meaning the grants that the single audit will give the most attention to. If you have never prepared this schedule before, you may wish to reach out to your auditor for guidance.

- Some of the pandemic funding is not subject to a single audit. Ensure you are familiar with which funding is and is not subject to a single audit for proper reporting on the SEFA. This point is crucial because it could be the difference between having or not having a single audit in the first place.

- Provider Relief Funds are unique funding in that although the funds are received (and possibly expended) in one period, they are not reportable until a future period. This can directly affect your schedule of expenditures of federal awards. Additionally, special audit requirements may apply. If you receive any of this funding, you should become familiar with compliance and reporting requirements.

- All expenditures must be reported separately, by grant, in your general ledger. For example, if you have Federal Grant A and Federal Grant B, you will need a way to associate how much of all costs, such as salaries, are charged to each grant. This is ideally accomplished with separate accounts or separate grant codes within the accounting system. The separation is essential to demonstrate you are not charging the same expenditures to multiple grants or ‘double-dipping.’

- Regardless of whether you need a single audit or not, as a recipient of federal funding, you should have a written procedures manual in addition to your policies that are specific to federal grants. It is important to understand that policies and procedures are two very different things. Your procedures manual should cover all compliance areas applicable to your grants, such as allowable costs and activities, reporting, earmarking, etc. The manual should be specific to your organization and in sufficient detail to document and demonstrate proper procedures, in addition to guiding employees responsible for compliance. The manual is especially important in the event of a changeover in the CFO or compliance officer position.

Ensure you are familiar with both the specific requirements of your grant and the Uniform Guidance (UG), which is outlined in the Code of Federal Regulations at 2 CFR 200. UG is the streamlined and consolidated guidance that governs all federal awards issued on or after December 26, 2014. A great deal of the single audit is focused on compliance with UG.

Contact Yeo & Yeo’s Nonprofit Services Group or your auditor if you think you may need a single audit for the first time or if you need help with any of the special considerations above.