Businesses Must Stay on Guard Against Invoice Fraud

Fraud is a pernicious problem for companies of all shapes and sizes. One broad type of crime that seems to be thriving as of late is invoice fraud.

In the second quarter of 2024, accounts payable software provider Medius released the results of a survey of 1,533 senior finance executives in the United States and United Kingdom. Respondents reported that their teams had seen, on average, 13 cases of attempted invoice fraud and nine cases of successful invoice fraud in the preceding 12 months. The average per-incident loss in the United States was $133,000 — which adds up to about $1.2 million annually.

Typical schemes

Invoice fraud can be perpetrated in various ways. Among the most common varieties is fraudulent billing. In billing schemes, a real or fake vendor sends an invoice for goods or services that the business never received — and may not have ordered in the first place.

Overbilling schemes are similar. Your company may have received goods it ordered, but the vendor’s invoice is higher than agreed upon. Duplicate billing, on the other hand, is where a fraud perpetrator sends you the same invoice more than once, even though you’ve already paid.

Employees sometimes commit invoice fraud as well. This can happen when a manager approves payments for personal purchases. In other cases, a manager might create fictitious vendors, issue invoices from the fake vendors and approve the invoices for payment.

Such schemes generally are more successful when employees collude. For example, one perpetrator might work in receiving and the other in accounts payable. Or a receiving worker might collude with a vendor or other outside party.

Best practices

The good news is there are some best practices that businesses can follow to discourage would-be perpetrators and catch those who try to commit invoice fraud. These include:

Know with whom you’re doing business. Verify the identity of any new supplier or vendor before working with that entity. Research its ownership, operating history, registered address and customer reviews. Also, ask for references so you can contact other companies that can vouch for its legitimacy.

Follow a thorough approval process. Establish a firm “no rubber stamp” policy for invoices. Train accounts payable staff to review them for red flags, such as unexpected changes in the amounts due or unusual payment terms. Manual alterations to an invoice should require additional scrutiny, as should the first several invoices from new vendors.

Instruct employees to contact an issuing vendor if anything seems strange or inaccurate about its invoice. In cases where the response lacks credibility or raises additional concerns, your business should decline to pay until the matter is resolved.

Implement additional antifraud controls as well. For instance, before approving payment, accounts payable staff should confirm with your receiving department that goods were delivered and check invoices against previous ones from the same vendor to ensure there are no discrepancies. Also, you may want to require more than one person to approve certain invoices for payment — such as those at or above a specified amount.

Leverage technology. Automating your accounts payable process can help prevent and detect invoice fraud. And, as you might expect, artificial intelligence (AI) is having an impact here.

One AI-driven technology called optical character recognition (OCR) can scan and read invoices to verify that line items and charged amounts match those vendors quoted you per your company’s financial records. OCR minimizes employee intervention, hinders collusion and makes diverting payments to personal accounts harder.

Decisive action

As the aforementioned survey indicates, invoice fraud is likely widespread. Be sure to put policies and procedures in place to prevent it as well as to respond swiftly and decisively if you suspect wrongdoing. Our firm can help you assess your accounts payable processes for efficiency, completeness and security.

© 2024

Enhancing Care Quality and Efficiency in Healthcare

At its core, patient access is about ensuring patients have access to high quality care and information they need in a timely and efficient manner.

From a provider perspective, patient access is essential for efficient practice operations, balancing patient demand with clinical resource productivity, managing patient populations and successfully managing value-based contracts.

Patients are increasingly demanding digital options for care access. According to BDO’s 2022 Patient Experience Survey, 81% of U.S. patients have used a patient portal. Of those that use patient portals, 87% find them helpful. According to BDO’s 2024 Healthcare CFO Outlook Survey, 98% of healthcare organizations are already piloting generative AI programs, and 47% of CFOs expect to increase their spending on technology implementation in the next 12 months. For providers to be successful, this investment in technology should offer the access options that patients prefer.

To ensure patients receive the care they need, provider organizations need to be as easy to navigate as possible. To that end, providers need to analyze key patient-facing systems and tap stakeholders to evaluate performance and implement digital solutions, including patient self-scheduling and online patient symptom evaluation. With the right digital tools, providers can expand patient access to both online and onsite care.

Improving patient access across an organization can be overwhelming. Fortunately, there are actions providers can take now to achieve immediate results for both onsite and virtual care: improve scheduling templates, refine referral strategies and upgrade call centers.

Why Should I Optimize Patient Access?

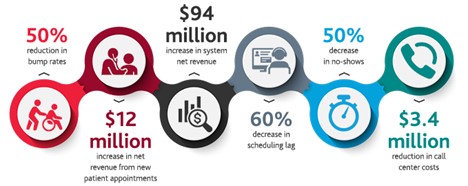

Organizations that optimize their patient access experience significant benefits. Some of the results clients have achieved include:

Scheduling Template Optimization

A positive patient experience relies on timely access to clinical services, which requires appointment scheduling and registration to be as seamless as possible. Providers who optimize their scheduling templates can support patient self-scheduling, which reduces call center costs and improves the overall patient experience.

In addition, scheduling template optimization allows for a better digital front door experience by enabling patients to take control of their care from the comfort of their smartphone or computer. Finally, scheduling template optimization is also critical for patient retention and practice growth.

Those looking to improve their scheduling templates should start here:

1. Review your current scheduling templates. As you review, ask yourself the following questions:

- Does the provider practice in more than one department?

- Which appointment types does the provider use?

- How long is each appointment type scheduled?

- Which appointments, if any, must happen on a certain day or at a certain time?

- Which appointments, if any, should occur within a few days of scheduling?

- Which appointments, if any, currently have a longer-than-desired lead time?

- How many appointments are scheduled per slot?

2. Revalidate the current rationale behind your templates. Your review should focus on three components:

- Template design assessments

- Template standards and maintenance policies

- Scheduling protocols, such as policies for productivity, use of blocks, bumps and session limits

3. After you’ve completed your reviews, implement adjustments to your scheduling templates to address identified gaps and inefficiencies.

4. Evaluate updated scheduling templates for ease and accessibility by testing the patient portal and call center.

5. Finally, identify and rebook displaced patients to minimize disruption to your patient population.

Improve Referral Strategy

Poor referral strategies often lead to the dreaded “referral blackhole” where patient care is compromised due to a lack of follow-up care. Improving workflows through an optimized referral process and scheduling patients through a “Work Queue” optimization improves patient retention and makes care easier on the part of the provider.

When seeking to improve your referral strategy, here are a few key steps:

1. Identify the KPIs you want to track to measure the efficacy of your referral strategy.

2. Assess your current referral policies and procedures to identify gaps.

3. Standardize your referral policies and procedures. In particular, you should focus on standardizing the following:

Internal and external referral management

Referral communication

Authorization and documentation

Operational reporting

4. Based on this standardization, implement consistent and streamlined referral workflows, supported by your health information technology system (ex. Epic).

5. Establish governance for your referral management standards/accountability.

6. Train your clinicians and front-office staff in the new referral process.

7. Take advantage of advanced decision tree solutions if your available technology platforms allow.

Optimize Call Center

A provider’s call center is often the first and last point of contact for patients. If a call center experience is frustrating or confusing, it discourages patients from returning to seek care.

To optimize your call center, consider taking these steps:

1. Review performance data, call center structure and the organizational goals tied to the success of the call center.

2. Engage stakeholders, including patients and staff, to understand the current state of the call center.

3. Use operational and benchmark data and stakeholder feedback to define KPIs.

4. Improve software, workflows, and tools to help boost patient engagement, call quality and call efficiency.

5. If your technology platforms allow, implement decision tree solutions to expand patient self-scheduling and enhance call center workflows.

6. Pilot a staffing model for an optimized call center before it goes live.

7. Provide implementation support and training before and after the optimized call center goes live.

8. Continue to regularly evaluate key performance indicators.

Don’t Wait to Optimize Patient Access

A good patient experience is essential to the financial health of any health system. Providers that are invested in improving the patient experience need to ensure they are making it as easy as possible for patients to access care.

Beyond providing easy access to appointments and referrals, providers should strive for a “zero touch” experience where patients can seamlessly pay bills, check-into appointments, access health records, review visit notes, request prescription refills and communicate with their clinicians. Optimizing scheduling templates, refining referral strategies and improving call center experiences are great first steps to improving patient access.

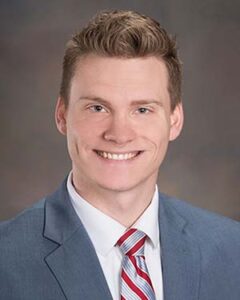

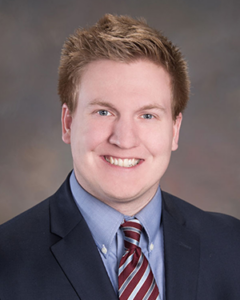

Yeo & Yeo, a leading Michigan-based accounting and advisory firm, is pleased to announce the recent promotion of five individuals to principal effective January 1, 2024. The new principals include Andrew Matuzak, CPA, PFS; Mike Rolka, CPA, CGFM; Christopher Sheridan, CPA, CVA; Rachel Van Slembrouck, CPA; and Alex Wilson, CPA.

“I am excited to have so many talented professionals joining our principal group,” says Dave Youngstrom, President & CEO. “They each bring distinct strengths and a commitment to personal growth, client service, and care for our people. I look forward to working with each of them more closely and seeing them continue their successful careers.”

Andrew Matuzak, CPA, PFS, is based in the Saginaw office. Matuzak co-leads Yeo & Yeo’s Trust/Estate/Gift Tax Services Group and the Death Care Services Group. He specializes in financial and retirement planning, as well as tax planning, and trust and estate administration. Matuzak is a member of the Michigan Funeral Directors Association and the Michigan Cemetery Association, and serves on the Northeastern Michigan Estate Planning Council board. He frequently contributes to Yeo & Yeo’s Everyday Business Podcast, educating listeners on tax, trust and estate, and wealth management topics. In the community, he serves as treasurer of the Thomas Township Business Association, treasurer of the Rotary Club of Saginaw Valley, and is a member of the Saginaw Valley State University Advisory Board Council.

Andrew Matuzak, CPA, PFS, is based in the Saginaw office. Matuzak co-leads Yeo & Yeo’s Trust/Estate/Gift Tax Services Group and the Death Care Services Group. He specializes in financial and retirement planning, as well as tax planning, and trust and estate administration. Matuzak is a member of the Michigan Funeral Directors Association and the Michigan Cemetery Association, and serves on the Northeastern Michigan Estate Planning Council board. He frequently contributes to Yeo & Yeo’s Everyday Business Podcast, educating listeners on tax, trust and estate, and wealth management topics. In the community, he serves as treasurer of the Thomas Township Business Association, treasurer of the Rotary Club of Saginaw Valley, and is a member of the Saginaw Valley State University Advisory Board Council.

Mike Rolka, CPA, CGFM, is based in the Auburn Hills office, specializing in audits of governmental entities. Rolka began his career in the Saginaw office and later transferred to the Auburn Hills office to support and help expand the firm’s audit and assurance services in the southeast Michigan market. He is a member of the Government Services Group and holds the Certified Government Financial Manager designation. He is a member of the Michigan Association of Certified Public Accountants’ Governmental Accounting and Auditing Professional Panel. He also serves on the Board of Directors and Standards Committee for the Michigan Government Finance Officers Association (MGFOA). In the community, Rolka serves on the Clinton River Watershed Council Finance Committee.

Mike Rolka, CPA, CGFM, is based in the Auburn Hills office, specializing in audits of governmental entities. Rolka began his career in the Saginaw office and later transferred to the Auburn Hills office to support and help expand the firm’s audit and assurance services in the southeast Michigan market. He is a member of the Government Services Group and holds the Certified Government Financial Manager designation. He is a member of the Michigan Association of Certified Public Accountants’ Governmental Accounting and Auditing Professional Panel. He also serves on the Board of Directors and Standards Committee for the Michigan Government Finance Officers Association (MGFOA). In the community, Rolka serves on the Clinton River Watershed Council Finance Committee.

Christopher Sheridan, CPA, CVA, leads the Business Valuation and Litigation Services Group and is a member of the Manufacturing Services Group. Based in the Saginaw office, he works with clients in various industries, offering consulting for financial reporting, tax issues, internal controls, and fraud prevention. He is a member of several professional organizations, including the Michigan Association of Certified Public Accountants’ Manufacturing Task Force, Great Lakes Bay Manufacturers Association, Central Michigan Manufacturers Association, and Michigan Manufacturers Association. In 2021, he was recognized as a “40 Under Forty” honoree by the National Association of Certified Valuators and Analysts / CTI. In the community, Sheridan serves on the board of the Montessori Children’s House of Bay City, Bay Future, and the Great Lakes Bay Economic Club. He is also an executive council member for the Stevens Center for Family Business.

Rachel Van Slembrouck, CPA, is based in the Saginaw office and is a member of the Healthcare Services Group. She specializes in outsourced accounting, strategic advisory services, client accounting software solutions, and tax planning and preparation. She has played a pivotal role in broadening the firm’s outsourced accounting offerings and assumed a lead role in guiding clients through the challenges of the PPP program amid the pandemic. She is highly knowledgeable in the Employee Retention Credit and is a QuickBooks ProAdvisor. In 2018, she was recognized with the Spirit of Yeo Award for going above and beyond to exemplify the firm’s mission and core values in serving our clients, communities, and people. In the community, she serves as a board member and is past chair of the Saginaw County Animal Care & Control Advisory Council.

Rachel Van Slembrouck, CPA, is based in the Saginaw office and is a member of the Healthcare Services Group. She specializes in outsourced accounting, strategic advisory services, client accounting software solutions, and tax planning and preparation. She has played a pivotal role in broadening the firm’s outsourced accounting offerings and assumed a lead role in guiding clients through the challenges of the PPP program amid the pandemic. She is highly knowledgeable in the Employee Retention Credit and is a QuickBooks ProAdvisor. In 2018, she was recognized with the Spirit of Yeo Award for going above and beyond to exemplify the firm’s mission and core values in serving our clients, communities, and people. In the community, she serves as a board member and is past chair of the Saginaw County Animal Care & Control Advisory Council.

Alex Wilson, CPA, is co-leader of the Cannabis Services Group, playing a key role in the firm’s entry into this industry and acquiring specialized expertise. He is also a member of the firm’s Agribusiness Services Group and Construction Services Group. He specializes in business advisory services, succession planning, and tax planning and preparation. Wilson is a member of many professional organizations, including the Michigan Association of Certified Public Accountants’ Agribusiness Task Force, Construction Industry CPAs/Consultants Association, and Associated Builders and Contractors – Greater Michigan. Demonstrating a profound commitment to community service and upholding the values of the firm, Wilson serves as the Yeo & Yeo Foundation’s board president. He is also the board treasurer of the Children’s Discovery Academy and serves on the Central Michigan University Accounting Advisory Council. He is based in the firm’s Alma office.

If you read the Internal Revenue Code (and you probably don’t want to!), you may be surprised to find that most business deductions aren’t specifically listed. For example, the tax law doesn’t explicitly state that you can deduct office supplies and certain other expenses. Some expenses are detailed in the tax code, but the general rule is contained in the first sentence of Section 162, which states you can write off “all the ordinary and necessary expenses paid or incurred during the taxable year in carrying on any trade or business.”

Basic definitions

In general, an expense is ordinary if it’s considered common or customary in the particular trade or business. For example, insurance premiums to protect a store would be an ordinary business expense in the retail industry.

A necessary expense is defined as one that’s helpful or appropriate. For example, let’s say a car dealership purchases an automated external defibrillator. It may not be necessary for the operation of the business, but it might be helpful and appropriate if an employee or customer suffers cardiac arrest.

It’s possible for an ordinary expense to be unnecessary — but, in order to be deductible, an expense must be ordinary and necessary.

In addition, a deductible amount must be reasonable in relation to the benefit expected. For example, if you’re attempting to land a $3,000 deal, a $65 lunch with a potential client should be OK with the IRS. (Keep in mind that the Tax Cuts and Jobs Act eliminated most deductions for entertainment expenses but retained the 50% deduction for business meals.)

Examples of taxpayers who lost deductions in court

Not surprisingly, the IRS and courts don’t always agree with taxpayers about what qualifies as ordinary and necessary expenditures. Here are three 2023 cases to illustrate some of the issues:

- A married couple owned an engineering firm. For two tax years, they claimed depreciation of $76,264 on three vehicles, but didn’t provide required details including each vehicle’s ownership, cost and useful life. They claimed $34,197 in mileage deductions and provided receipts and mileage logs, but the U.S. Tax Court found they didn’t show any related business purposes. The court also found the mileage claimed included commuting costs, which can’t be written off. The court disallowed these deductions and assessed taxes and penalties. (TC Memo 2023-39)

- The Tax Court ruled that a married couple wasn’t entitled to business tax deductions because the husband’s consulting company failed to show that it was engaged in a trade or business. In fact, invoices produced by the consulting company predated its incorporation. And the court ruled that even if the expenses were legitimate, they weren’t properly substantiated. (TC Memo 2023-80)

- A physician specializing in gene therapy had multiple legal issues and deducted legal expenses of $360,295 for two years on joint Schedule C business tax returns. The Tax Court found that most of the legal fees were to defend the husband against personal conduct issues. The court denied the deduction for personal legal expenses but allowed a deduction for $13,000 for business-related legal expenses. (TC Memo 2023-42)

Proceed with caution

The deductibility of some expenses is clear. But for other expenses, it can get more complicated. Generally, if an expense seems like it’s not normal in your industry — or if it could be considered fun, personal or extravagant in nature — you should proceed with caution. And keep careful records to substantiate the expenses you’re deducting. Consult with us for guidance.

© 2023