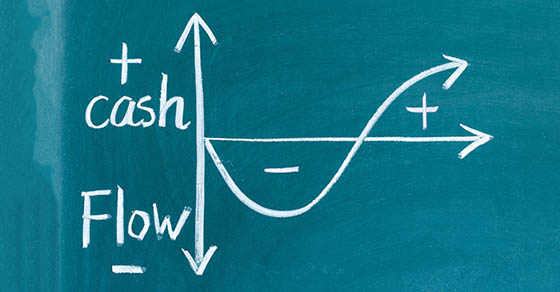

Manufacturers: Achieving and Maintaining a Strong Cash Flow Requires Diligence

Every manufacturer is different, so the right cash flow strategies depend on your situation. Let’s take a closer look at several areas where you may find ways to improve your cash flow.

Cash flow projections

You can’t manage cash flow unless you monitor and measure it. In good times, the income statement usually receives top billing. But in uncertain times, the balance sheet should play a more prominent role. While the income statement is a good gauge of past performance, the balance sheet provides a clearer picture of your current assets and liabilities and the amount of cash you’ll need in the coming weeks and months.

Project cash flow under best-case, worst-case and most-likely scenarios and have contingency plans in place for each. Monitor your actual results regularly to spot negative cash flow trends early and address them quickly. We can help you create a monitoring process.

Customers

Collecting from customers is key to maintaining strong cash flow, so it’s critical to evaluate and manage your customer base. If your manufacturing company is heavily concentrated in a handful of customers, consider options for growing that base, such as expanding into new markets, developing new products, or exploring new marketing techniques. Concentration risks generally happen when one customer represents more than 10% of your transactions.

Also, be sure to evaluate customers’ credit risk. Have their businesses been negatively affected by the pandemic and the resulting economic turmoil? How has this impacted their ability to pay?

Receivables

Examine ways to convert receivables into cash more quickly. Start by ensuring that invoices are issued on a timely basis. Also, provide customers with regular reminders before their payments are due. Consider offering discounts for early payment. Ask for deposits for custom jobs and milestone payments for long-term projects.

Another way to gain some stability in this area is through accounts receivable factoring. Factoring simply means selling receivables to a financial institution or other third party (the “factor”) at a discount. You obtain quick access to cash or a line of credit, and the factor takes responsibility for collecting receivables from your customers.

Before you go this route, be sure to consider the pros and cons. Pros include immediate access to cash and avoidance of many of the headaches associated with collecting from customers. Cons include the expense — factoring fees can be higher than interest rates on commercial loans — and potential customer confusion.

Vendors and suppliers

A concentrated supplier base can be just as damaging to a manufacturer’s cash flow as a concentrated customer base. The failure of a major supplier can hinder your ability to fulfill orders or meet demand. Consider ways you can build a more diversified supplier base.

Contact your vendors and suppliers to coordinate the timing of payments. They may be willing to offer extended payment terms or early payment discounts.

Inventory

Managing inventory can be a delicate balancing act. On one hand, reducing stock levels of raw materials or inventories of finished goods can help boost cash flow. On the other hand, increasing certain inventory levels can help mitigate supply chain risks and avoid raw material shortages.

Focused inventory management can help you strike a balance between conserving cash and meeting customer demand. To free up cash and reduce storage costs, consider liquidating obsolete or slow-moving inventory.

Overall efficiency

Don’t overlook the potential impact of efficiency improvements on cash flow. Look for opportunities to streamline processes by redesigning the factory layout, optimizing workflows or taking advantage of automation.

Also consider opportunities for cutting or eliminating expenses, either temporarily or permanently. Examples include reducing spending on nonessential travel, leasing equipment instead of buying it, reducing work hours, shifting work from temporary to existing permanent staff and delaying capital expenditures.

An ongoing priority

Managing your cash flow is critical during both good times and bad. We can help you monitor your cash flow and assesses its health.

© 2023