Background

It is here – GASB Statement No. 87, Leases. This GASB must be implemented in school districts’ June 30, 2022, financial statements. The objective of the new GASB is to improve accounting and financial reporting for leases. Another objective is to increase financial statements’ usefulness by recognizing certain lease assets and liabilities for leases that were previously classified as operating leases and recognized as inflows or outflows of resources based on the contract’s payment provisions. GASB 87 requires a lessee to recognize a lease liability and an intangible right-to-use lease asset. A lessor must recognize a lease receivable and a deferred inflow of resources.

What to do now

Get lease information ready, amend the fiscal year 2021-22 budget for any new current year leases (exceeding one year), and make journal entries for leases before closing out the current fiscal year.

Information to collect

For current leases:

- Lease description

- Original lease term

- Any renewal options, and the determination of the likelihood of utilizing those options

- Components of the payments (fixed, variable, interest rate)

- Who has the right to terminate the lease

- Lease obligation maturities for the next five years and beyond (similar to debt maturity schedule)

Practical hint: Short-term (less than one year) leases will be recorded as operating leases had been. Leases over one year will be recorded on district-wide financials, and in the year of inception, the lease will be recorded on the fund level statements.

How to Calculate

Leases (where the district is the lessee) existing prior to 7/1/21 (before this fiscal year)

- Calculate lease liability as of 7/1/21. This will be the right-of-use asset and liability for district-wide beginning balances.

- This will not change fund level statements.

Leases existing after 7/1/21 (in this fiscal year)

- Calculate the right-of-use asset/lease liability. Practical hint: Total cost of leased equipment (as if a “capital lease”).

- Fund level: In the current fiscal year ending June 30, 2022 – this will be included as a:

- Revenue: Other financing sources – lease financing

- Expenditure: Lease right-to-use assets (capital outlay)

- URGENT: Include Revenue and Expenditure amounts in final budget amendments for the current fiscal year (ending June 30, 2022).

- District-wide level: In the current fiscal year ending June 30, 2022 – this will be included as:

- Asset: Right-to-use assets

- Liability: Lease liability

Leases (where the district is the lessor)

- Calculate lease receivable as of 6/30/2022. This will be recorded as an Account Receivable and Deferred inflow.

- This will change fund level statements. It will be on both the district-wide and governmental fund statements.

For the fiscal year 2022-23 and beyond, maintain the above list of information on leases. Work with your auditor, if necessary, to determine which leases require the underlying asset to be recorded as a right-to-use asset and include such leases in budgets going forward.

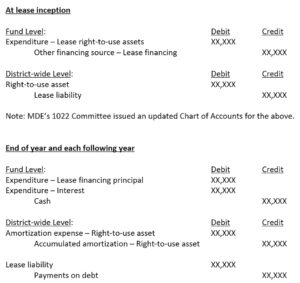

Journal Entries