Whip Jobs into Shape with Work in Progress (WIP) Summary

What if you need to see the profitability of a project while it’s happening? You may be struggling with matching the timing of your revenue to your costs because you invoice in advance of the work being completed. The Job Work in Progress Report (WIP) Summary can be used by contractors or other businesses that progress or advance bill their customers.

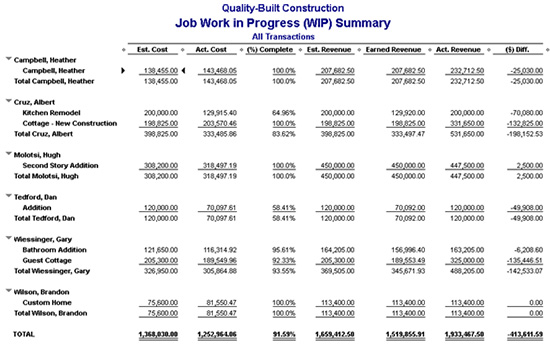

The WIP Report Summary provides a synopsis of a project’s related information such as estimated and actual cost, the percent complete and the estimated, earned and actual revenue.

Find the Job Work in Progress Summary by Choosing Reports, then Jobs, Time & Mileage. Then select Job WIP Summary.

Note: Only jobs with a related Estimate transaction in QuickBooks will appear on this report.

When viewing the report, you’ll see an Earned Revenue column. This column provides the amount you’ve earned on the job, regardless of how much you have invoiced to the customer. This is calculated by taking the Estimated Revenue column and multiplying by the (%) Complete column.

The (%) Complete column is derived by dividing The Actual Cost column by the Estimated Cost column. In other words, the report assumes that if you have incurred a certain portion of your total estimated expenses, then that same % of revenue has been earned. In many cases, the amount of earned revenue will vastly differ from the amount that has been invoiced to the customer. The ($) Diff column essentially becomes your “over/under billed” amount and can be used to make the accounting adjustment in QuickBooks.

Note: if a job’s expenses are over budget, the (%) Complete column will assume the job is 100% complete.

© 2017